Review Article - Journal of Finance and Marketing (2023) Volume 7, Issue 5

The effect of commercial bank financing on agricultural output in Nigeria.

Akinuli Bankole Olu*, Osagiede Manson

Department of Banking and Finance, University of Benin, Edo State, Nigeria

- Corresponding Author:

- Akinuli Bankole Olu

Department of Banking and Finance,

University of Benin,

Edo State,

Nigeria

E-mail: boakinuli@gmail.com

Received: 17-May-2023, Manuscript No. AAJFM-23-99142; Editor assigned: 19-May-2023, AAJFM-23-99142 (PQ); Reviewed: 02-June-2023, QC No. AAJFM-23-99142; Revised: 17-Jul-2023, Manuscript No. AAJFM-23-99142 (R); Published: 24-Jul-2023, DOI:10.35841/aajfm.7.5.196

Citation: Olu AB, Manson O. The effect of commercial bank financing on agricultural output in Nigeria. J Fin Mark. 2023;7(5):1-8.

Abstract

This study examined the influence of agricultural financing by deposit money bank and government on agricultural output in Nigeria. The time series data used spanning between 1983 up to 2022 culled from central bank of Nigeria statistical bulletin. The study employed simple ordinary least square analysis. Both pre-test and post-test analyses conducted revealed suitable results. The study found out that banks and government’s financing activities of agriculture have positive influence on the agricultural output within the period of investigation. It is imperative for the government to make agriculture attractive to young and vibrant men who have what it takes to sustain the nation, reduce acute shortage of food production and thereby making enough food available for local consumption and for exportation and hence garner foreign currencies from agricultural products. Also, the government should remove the bottlenecks farmers face while trying to secure banks’ loans for their operations.

Keywords

Commercial bank financing, Agricultural output and Nigeria, Bottlenecks farmers, Agricultural products, Government’s financing activities

Introduction

The agricultural sector is unarguably the most fundamental sector of Nigeria economy. This is due to the fact that agriculture provides livelihoods to the teeming population in Nigeria and other emerging economies especially those in rural areas. According to Doris, agricultural sector accounts for 65% of Nigerias working population both in urban and rural areas. In the 1960’s agricultural sector notably occupied an enviable position in Nigerian economy. It maintained a leading position in palm oil exports ranked second in cocoa exports and surpasses Argentina and United States of America (USA) in groundnut exports, Sulaimon, Ayeomoni and Aladejana, opined that agriculture contributed 90% of Nigerias GDP and foreign exchange before oil boom was discovered in commercial quantity in the early 1970’s. This trend has however changed over the years due to Nigerias over dependence on revenue from the sales of crude oil which led to the huge neglect of the agricultural sector [1].

The Nigerian government over the last decade decided to take a stance by introducing different agricultural programs in order to bring agriculture to its pride of place. This led to the introduction of programs such as Agricultural Transformation Agenda (ATA) in 2011. ATA was lunched with the aim of achieving food security, creating jobs and reducing poverty in Nigeria. The program focuses on increasing productivity in agriculture by supporting farmers with inputs, credit and market linkages. This program was followed in 2012 with Growth Enhancement Support Scheme (GESS) as a component of ATA. The program aimed at increasing farmers access to improved seeds, fertilizers, and other agricultural inputs through a subsidy scheme [2]. As a follow up to GESS, Anchor Borrowers Program (ABP) was introduced in 2015 as part of efforts to improve farmer’s access to credit. The program provides loans to small holder farmers to cultivate specific crops such as maize, wheat and rice with the aim of increasing local production and reducing food importation. In 2016, Presidential Fertilizer Initiative (PFI) was introduced with the aim of reviving local fertilizer production and reducing the cost of fertilizer in Nigeria. Recent among several programs introduced by the federal government of Nigeria to revamp agriculture is the Livestock Transformation Plan (LTP) in 2019 [3]. The LTP was aimed at improving livestock productivity, and promoting food security. The program focuses on promoting ranching and other modern livestock management practices. Interestingly, these programs seem inadequate in revamping agriculture in the country without the contributions of commercial banks financing [4].

Irrespective of efforts by Nigerian government towards improving agricultural productivity, agriculture is exposed to a number of constraints at all levels. One of such constraint is limited access to credit from commercial banks. This makes it difficult for small holder farmers to access credit facilities from formal financial institutions such as commercial banks. Universally, banking sector has been acknowledged as the catalyst of growth and development of a nation. However, commercial banks in Nigeria are not usually interested in allocating credit to agricultural sector due to the fact that agriculture has not been accorded priority in credit allocation over the years. Thus the inadequate commercial banks credit allocated to agricultural sector over the years is one of the reasons for low level economic development in Nigeria [5].

Literature Review

Agricultural sector plays major role in the economic development of developing countries through its enormous contribution to GDP. Nigeria agricultural sector contributes about 90% of the country’s GDP. Indeed, the contributions of agriculture cannot be achieved without the fundamental role of banking sector of the economy. Therefore, King and Levine, Bayoumi and Melander, Driscoll, Akpansung and Babalola opined that the essential role of banking sector to the real sector (agriculture) development by mobilizing resources from savers and allocating of such savings as loans to credit worthy customers with a view to promote growth and sustainability of the economy is vital. According to Kolapo, Ayeni and Oke, the intermediation role played by banking sector can be said to be a catalyst for economic growth and development based on the premise that banks mobilize savings in form of deposits from individual, entities, government and corporate bodies as investment funds and make them available to users of such resources for investment purposes [6]. Banks therefore guarantee that mobilized deposit funds are properly converted into productive capital. Okuneye and Ajayi stated that agricultural financing is multi-faceted and multi-dimensional which can be in form of personal savings, borrowing from friends and relatives, cooperative societies, credit from commercial banks. It is noteworthy that in financing of agriculture on commercial scale, the role of banks is indispensable [7].

Empirical literature

Adesina, Tomiwa and Eniola assessed the impact of agricultural financing on economic performance in Nigeria employing secondary data, a test for unit root, Bound co-integration and error correction modeling to empirically estimate the coefficient of the parameter. The statistical decision of the analysis was based on 5% (0.05) level of significance. The result revealed that in the long-run, Agricultural Credit Guarantee Scheme Fund (ACGSF) is the most influential agricultural financing variable that contributed to economic performance as it indicated that ACGSF had strong positive impact on growth rate of the Nigerian economy [8]. Chisasa and Makina applied time series data from 1970 to 2011 to investigate the dynamic relationship between bank credit and agricultural output; the result indicated negative impact on agricultural output in the short-run which reflected uncertainties of institutional credit in South Africa. Nakazi and Sunday, using quarterly time series data sourced from bank of Uganda and Uganda Bureau of Statistics over the sample period of 2008Q3 to 2018Q4, the study applied Autoregressive Distributive Lag (ARDL) approach to examine that the short run and long run relationship between commercial banks credit and Ugandas agricultural GDP performance, in the long run the study revealed that commercial bank credit have significant positive impact on agricultural output [9]. Ammani applied the OLS method to investigate the effect of credit on agriculture; the study found that formal credit had a positive influence on productivity of crops, livestock and fishing sectors [10].

In a related study Nwokoro examines the effect of commercial bank on agricultural output using OLS and error correction model on Nigerias 1980 to 2014 data; found out that banks credit had a positive effect GDP. Oyakhilomen, Omadachi and Zibah, applied Johansen co-integration test to examine the relationship between cocoa production in Nigeria and agricultural credit guarantee scheme fund using time series data from 1981 to 2011, the study further revealed that there was no co-integrating relationship between cocoa production in Nigeria and agricultural credit guarantee scheme fund over the period of study [11]. Nnamocha and Charles employed Error Correction Mechanism (ECM) to study the influence that bank loan and advances have on agricultural production in Nigeria between 1970 and 2013, the study indicated that bank loans and advances and industrial output positively contributed to agricultural output in Nigeria in the long run while industrial output was found to affect agricultural production in the short run [12]. A further study by Adewole, Adekanmi and Gabriel examines sectorial distribution of commercial banks loans and advances to agricultural sector, liquidity ratio, cash reserve ratios and money market minimum rediscount rates from the period of 2002 to 2014 in Nigeria, using multiple regression of ordinary least square, the result indicated that cash reserve requirement, liquidity ratio and discount rate have no significant effect in financing agricultural sector. Ahmad et al., applied Autoregressive Distributive Lag (ARDL) bound testing approach on annual time series data from 1973 to 2014 to analyse the long run term relationship between agricultural credit disbursed through formal institutions and agricultural GDP and the empirical findings indicated the evidence of long run relationship between agricultural credit and agricultural GDP [13].

Udoka, Mbak and Duke investigated the effect of commercial banks credit on agricultural output in Nigeria employing the Ordinary Least Square (OLS) regression technic, the result revealed that there was positive and significant relationship between agricultural credit guarantee scheme fund and agricultural production in Nigeria [14]. Agunuwa, Inaya and Proso investigated the impact of commercial banks credit on agricultural productivity in, using the Ordinary Least Square (OLS) technics; the result further indicated negative relationship between interest rate and agricultural productivity [15]. Ubesie, et al., and Nteegah, indicated that commercial banks credit allocated to agricultural sector had no significant effect on economic growth in Nigeria. The study of Oladapo and Adefemi, Akujuobi and Nwezeaku, show that commercial banks credit allocation to agricultural sector had a significant positive effect on economic growth in Nigeria [15].

Gap in the empirical literature

A detailed review of the above empirical literature indicates that most of the studies utilized OLS method and have submitted that bank credit have positive and significant relationship with agricultural output (GDP). For instance, Adesina, Tomiwa and Eniola, Nakazi and Sunday, Ammani, Nnamocha and Charles, Udoka, Mbak and Duke submitted that bank credit have significant positive relationship with agricultural output with exception of interest rate which shows negative relationship with agricultural productivity, Agunuwa, Inaya, and Proso [16].

In terms of the method of data analysis, most of the studies reviewed employed the use of time series data, the Ordinary Least Square (OLS), error correction, Johansen co-integration model and test for unit root, only less than 10% of the studies reviewed consider the effect of interest rate and agricultural credit guarantee scheme. This study will however employ the use of OLS, time series data, test for unit root and cointegration method to examine the effects of the components of commercial bank (i.e., commercial bank credit, agricultural credit guarantee scheme fund, and interest rate) on agricultural output in Nigeria [17].

Methodology

Research design

This study seeks to investigate the effect of commercial banks on agricultural financing and agricultural development in Nigeria. The study will rely on ex-post facto research design because the data to be used in evaluating the effect of commercial banks on agricultural financing and agricultural development in Nigeria cannot be manipulated or influenced in any way. Ex-post facto research design is most appropriate where research data are time series and cannot be manipulated [18].

Sources of data and variables

The study uses secondary data which were sourced from the central bank of Nigeria statistical bulletin from various issues from 1983 up to 2022. Thus, the validity of this research work is largely dependent on the accuracy and authentication of the periodical reports released by the CBN annual reports.

This study invariably investigates the impact of commercial banks on agricultural financing and agricultural development in Nigeria. The variables to be used include: Agricultural output-AGROUTP (proxy as agricultural development) which is dependent variable and others which are explanatory variables include: Agricultural credit guarantee scheme fund on agricultural sector-ACGS, commercial banks’ lending/credit to agricultural sector-CBLA and interest rate-INTR [19].

Specification of the empirical model

All data collection for the purpose of the study were evaluated, cross checked, compared and critically analysed. The gauge, the relationship between the commercial banks on agricultural financing and agricultural development, a simple closed macro-economic model was applied. The model adopted in this is patterned after the work of Okafor. Okafor investigated the effects of commercial banks on agricultural financing and agricultural development in Nigeria. His model specified that agricultural output (proxy as agricultural development) as dependent variable and is significantly influenced explanatory variables [20]. The model is specified thus:

In implicit form:

AGO=F (AGO, CAS, GAS, ACGS, INTR) (1)

That is, in explicit form:

AGO=β0+β1 CAS+β2 GAS+β3 INTR+β4 ACGS+U (2)

Where: AGO=Agricultural Output

CAS=Credit to Agricultural Sector

GAS=Government spending on Agricultural Sector

ACGS=Agricultural Credit Guarantee scheme fund on agricultural Sector

INTR=Interest Rate

U=Stochastic error term

β1, β2, β3, β4=Slope of the regression equation

However, in this study, the model above would be slightly adjusted and modified as follows:

AGROUTP=F (CBLA, ACGS, INTR) (3)

AGROUTP=λ0+λ1CBLA+λ2ACGS+λ3INTR+μ (4)

By log linearization the equation becomes:

LogAGROUTP=λ0+λ1 logCBLA+λ2 logACGS+λ3 INTR+∞ (5)

Where:

AGROUTP=Agricultural Output (proxy for Agricultural development)

CBLA=Commercial Banks’ Lending/credit to Agricultural development

ACGS=Agricultural Credit Guarantee Scheme fund on agricultural sector

INTR=Interest Rate

∞=Stochastic error term

λ1, λ2, λ3=slope of the regression equation

A priori expectation

λ1, λ2, λ3>0

Data analysis and interpretation

Table 1 above presented the descriptive statistics for the model postulated: Agricultural Output (AGROUTP), Commercial Bank Credit to Agricultural Sector (CBLA), Agricultural Credit Guarantee Scheme fund on agricultural sector (ACGS) and Interest Rate (INTR). The average mean of the variables ranges between 0.0000000208 and 8216.517. While the highest maximum descriptive statistics is AGROUTP with the value of 18348.18, commercial bank credit to agricultural sector, interest rate, agricultural credit guarantee scheme fund on agricultural sector followed in that order with the value of 1049.678, 36.09000 and 00000000833 respectively. There are 40 observations in all based on the number of years of our investigation (Table 2) [21].

| ACGS | AGROUTP | CBLA | INTR | |

|---|---|---|---|---|

| Mean | 2.08E+08 | 8216.517 | 160.9836 | 19.27800 |

| Median | 544.9972 | 4932.757 | 44.79520 | 18.38500 |

| Maximum | 8.33E+09 | 18348.18 | 1049.678 | 36.09000 |

| Minimum | 24.65490 | 2303.505 | 0.590600 | 10.00000 |

| Std. dev. | 1.32E+09 | 5530.398 | 248.0323 | 5.855841 |

| Observations | 40 | 40 | 40 | 40 |

Table 1. Descriptive statistics.

Correlation coefficient

| Value of Co-efficient | Relation between variables | Signs |

|---|---|---|

| 0.00-0.19 | Very weak | +ve or –ve |

| 0.20-0.39 | Weak | +ve or –ve |

| 0.40-0.59 | Moderate | +ve or –ve |

| 0.60-0.79 | Strong | +ve or –ve |

| 0.80-1.00 | Very strong | +ve or –ve |

Table 2. Interpretation of strength of correlation co-efficient.

Table 3 reported correlation coefficient for the model postulated in this study. Inference from the correlation coefficient indicates that Agricultural Output (AGROUTP) being the dependent variable has a positive and very weak relationship with agricultural credit guarantee scheme fund on agricultural sector-ACGS though the result is not statistically significant. AGROUTP has a positive and very strong correlation coefficient. The result is statistically significant. Meanwhile, interest rate has a negative and weak correlation coefficient with the AGROUTP. The result is not statistically significant.

| Correlation probability | ACGS | AGROUTP | CBLA | INTR |

|---|---|---|---|---|

| ACGS | 1.000000 | |||

| AGROUTP | 0.120631 0.4584 | 1.000000 | ||

| CBLA | -0.016539 0.9194 |

0.867329 0.0000 |

1.000000 | |

| INTR | -0.007976 0.9610 |

-0.292464 0.0671 |

-0.357745 0.0234 |

1.000000 |

Table 3. Correlation Co-efficient analysis.

Unit root test

Non-stationary data produces spurious regression; hence the result may be misleading. Therefore, it is cognizant to establish the stationary of data. This is carried out using the Augmented-Dickey Fuller (ADF) unit root test. The decision rule is that the ADF test statistic value must be greater than the Mackinnon critical value at 5% and at absolute value. The table below shows the summary of unit root test conducted on the parameter at level (Table 4).

| Variables | ADF test statistic value | Mackinnon critical value at 5% | Prob. | Remark |

|---|---|---|---|---|

| AGROUTP | -1.8045 | -3.5297 | 0.6833 | Non-stationary |

| CBLA | 3.2246 | -3.5297 | 1.0000 | Non-stationary |

| INTR | -2.7248 | -3.5297 | 0.2328 | Non-stationary |

| ACGS | -6.2461 | -3.5297 | 0.0000 | Stationary |

| Source: Author’s own computation (2023) | ||||

Table 4. Unit root test at level.

From the Table 4 above, it can be deduced that all the variables are non-stationary because they have their Augmented-Dickey Fuller (ADF) statistics less than Mackinnon critical value at 5% except the ACGS which is stationary at level. This led to the testing for stationarity at first difference and second difference. Table 4 below shows the order of integration as shown under remarks. The series of data must be stationary otherwise the outcome of the entire analysis might produce spurious results (Table 5).

| Variables | ADF test statistic value | Mackinnon critical value at 5% | Prob. | Remark |

|---|---|---|---|---|

| AGROUTP | -5.6324 | -3.5330 | 0.0002 | Stationary I(1) |

| CBLA | -3.8809 | -3.5330 | 0.0228 | Stationary I(1) |

| INTR | -6.8406 | -3.5366 | 0.0000 | Stationary I(1) |

| ACGS | -6.2461 | -3.5297 | 0.0000 | Stationary I(0) |

| Source: Author’s own computation (2023) | ||||

Table 5. Unit root test at first/second difference.

Inference from the unit root test in Table 5 indicates that all the variables are now stationary at first difference because they have their respective ADF statistics greater than Mackinnon critical value at 5%. The fact that some variables are stationary at first order of difference and others at level shows that the variables might not be co-integrated in the same order (Tables 6 and 7).

| Dependent variable: AGROUTP | ||||

|---|---|---|---|---|

| Short-run estimation | ||||

| Variable | Coefficient | Std. error | t-statistic | Prob |

| C | 7.909211 | 0.114477 | 69.08978 | 0.0000 |

| LOG(CBLA) | 0.285332 | 0.016399 | 17.39978 | 0.0000 |

| LOG(ACGS) | 0.028491 | 0.010887 | 2.617117 | 0.0129 |

| INTR | -0.016988 | 0.004728 | -3.592857 | 0.0010 |

| Source: Author’s own computation (2023) | ||||

Table 6. Presentation of estimation technique and result.

| Statistical properties | Post diagnostic test results | ||

|---|---|---|---|

| R-squared | 0.946793 | B-G serial correlation LM (F-statistics) | 9.103142 |

| Adj R-squared | 0.942360 | B-G serial correlation LM Prob F (1, 28) | 0.0007 |

| F-statistics | 213.5363 | Heteroskedasticity test: Breusch-pagan-godfrey (F-stat) | 1.697783 |

| Prob (F-statistcis) | 0.000000 | Heteroskedasticity test: Breusch-pagan-godfrey (Prob) | 0.1848 |

| Durbin watson statistics | 0.947035 | ||

| Akaike info criterion | |||

| Model selection | NA | ||

| Estimation technique | BLUE (OLS) | ||

| Sources: Author’s computation (2023) | |||

Table 7. Statistical properties and post diagnostic results.

Results and Discussion

From the Table 6 and Table 7 above, results of the model postulated were presented.

Commercial bank credit to agricultural sector (CBLA)

Commercial bank credit to agricultural sector has a positive influence on the Agricultural Output (AGROUTP). Inference from estimation technique indicates that coefficient of AGROUTP with the value of 0.285332 implies that one percentage increase in CBLA will induce 28.5332% increase in the agricultural output. The result is statistically significant with the probability value of 0.0000 which is even significant at 1%. The result also agrees with the a priori expectation as a positive sign is projected. Policy implication connotes that commercial is really influencing agricultural development in an impressive manner. Rice pyramids displayed recent in the country that have attracted much accolades the agricultural development in terms of rice production cannot be far from the influence of banks’ credits and loans to the agricultural sector in Nigeria.

Agricultural Credit Guarantee Scheme fund on agricultural sector-ACGS

Agricultural credit guarantee scheme funds on agricultural sector have positive influence on the agricultural output within the period investigation in this study. The coefficient result of ACGS indicates that one percent increase in the ACGS will stimulate 0.028491 (or 2.8491%) boost in the agricultural output in Nigeria, the result is statistically significant with the probability value of 0.0129. The outcome also aligns with the a priori expectation as a positive relationship is anticipated in this study. The government should expand its scope of commitment to the agricultural sector so as to take Nigerian food production and income from that sector to the next level.

Interest Rate (INTR)

Agricultural output has a negative relationship with the interest rate within the period of reviews. The coefficient of interest rate of -0.016988 implies that a unit or one percent increase in the INTR will stimulate 0.016988 or (1.6988%) decrease in the agricultural output in Nigeria. Thus, the government should endeavour to examine how to alleviate the plight of farmers in this regards. The result is statistically significant with the probability value of 0.0010 which is even significant at 1%. The result agrees with the a priori expectation as a negative relationship is envisaged in this study.

Constant (c)

Constant implies that if all the parameters are held constant or fixed except it, the agricultural output will still have positive relationship with it (constant). Coefficient of constant with the value of 7.909211 implies that a unit increase in the constant will induce 7.909211 (or 790.9211%) increase in the agricultural output within the period of investigation. The result is statistically significant with the probability value of 0.0000.

The post-diagnostic results

Table 7 above reported the statistical properties and post diagnostics test results for the model postulated in this study. The coefficient of determination which is R-Squared of 0.946793 indicates that the explanatory variables are able to account for 94.67% variation on the AGROUTP (proxy for agricultural development). The remaining 5.33% deviation would be captured by the error term. This result is further corroborated with the adjusted R-squared of 94.23%.

The F-statistics result of 213.5363 and probability distribution of 0.000000 indicates that the entire regression analysis is statistically significant. Thus, it could be established that agricultural output has been positively influenced by the government spending to the agricultural sector and bank’s credit to the sector in Nigeria.

Heteroskedasticity test of 1.697783 with the probability value of 0.1848 indicates that the entire regression analysis may not be affected by the serial correlation problem.

Breusch-Godfrey serial correlation LM test measures whether or not there is presence of serial correlation. The null hypothesis of presence of serial correlation problem would be rejected since the probability is greater than 5%. The F-statistics of B-G serial correlation of 1.697783 and probability value of 0.1848 indicates that the entire analysis may not suffer from serial correlation problem.

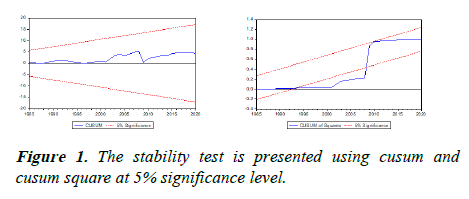

Stability test

The stability test measures graphically whether or not the regression analysis is relatively stable and falls within the acceptable region at 5% significance level (Figure 1).

Figure 1 reported the cusum and cusum of squared stability test result. These results show that the cusum test fall within the acceptable region at 5% significance level and hence the analysis is stable. Meanwhile, cusum of squared test indicates a slight deviation as it falls out the acceptable region briefly before moving back within the region. In a nutshell, the overall results had provided substantial evidences to attest to the fact agricultural financing has been surviving and supported by the two legs of government spending and banks’ credit to the sector within the period of investigation.

Conclusion

This study examined the impact of agricultural financing by deposit money banks and government on agricultural development in Nigeria. The data used are spanning the period of 1983-2023. Augmented-Dickey fuller unit root test was carried out to ascertain the stationarity of the data used. All the variables adopted in this study are stationary. A good number of econometrics techniques were used to analyze our time series data which include but not limited to: Unit root test, descriptive statistics test and correlation coefficient. All these tests denote pre-test analysis, meanwhile the post-test include stability test, Durbin Watson test, serial correlation test etc., were conducted in this study. Thus, based on the overall findings, it is concluded that government spending and bank’s credit to agricultural sector have had impressive influence on agricultural output in Nigeria. There is need to diversify the economic to pave way for other viable sources of revenue to the federal, state and local governments. The federal government should attach more importance to agricultural development in Nigeria. There are lots of revenues to be derived from agriculture. Thus, the time has come to diversify the economy to pave way for multiple sources of income to the three ties of government. The federal government should see to removing the hurdles faced the farmers in sourcing for funds to boost their production. There is need for the government to put in place all the necessary infrastructures to encourage young graduate to take up farming as professions. The federal government should step up their efforts in subsidizing farms tools and other materials needed to boost farm produce.

References

- Adeshina KF, Tomiwa OY. Eniola OM. Agricultural financing and economic performance in Nigeria. Asian J Agric Ext Economics Sociol. 2020;38(7):61-74.

[Crossref]

- Adewole JA, Adekanmi AD, Gabriel I. An assessment of the contributions of commercial banks to agricultural financing in the Nigerian Economy. Int J Adv Res. 2015;1(2):1-16.

- Agunuwa KV, Inaya L, Proso T. Impact of commercial banks credit on agricultural Productivity in Nigeria (Time Series Analysis 1980-2013). Int J Acad Res Bus Soc Sci. 2015;5(11):337-50.

- Akpansung AO, Babalola SJ. Banking sector credit and economic growth in Nigeria: An empirical investigation. CBN J Appl Stat. 2010;2(2):51-62.

- Ammani AA. An investigation into the relationship between agricultural production and formal credit supply in Nigeri. Int J Agric For. 2012;2(1):46-52.

- Ayeomoni IO, Aladejana SA. Agricultural credit and economic growth nexus. Evidence from Nigeria. Int J Acad Res Account Finance Manag Sci. 2016;6(2):146-58.

- Bayoumi T, Melander O. Credit matters: Empirical evidence on US macro financial linkages. International Monetary Fund publisher. Unitd States of America. 2008.

- Beck T, Levine R. Industry growth and capital allocation: Does having a market or bank based system matter? J Financ Econ. 1998;36(4):763-81.

- Chisasa J, Markina D. Bank credit and agricultural output in South Africa: Co-integration, short run dynamics and causality. J Appl Bus Res. 2015;31(2):489-500.

- King R, Levine R. Finance and growth: Schumpeter might be right. Q J Econ. 1993;108:7681-737.

- Nakazi F, Sunday N. The effect of commercial banks agricultural credit on agricultural growth in Uganda. African J. Econ Rev. 2020;8.

- Nnamocha PN, Eke CN. Bank credit and agricultural output in Nigeria: An Error Correction Model (ECM) approach. Br J Manag. 2015;10(2):1-12.

- Nteegah A. Banking sector consolidation: Possible effects for sectorial credit allocation and economic growth in Nigeria. Int J Soc Sci Econ. 2017;3(9):91-101.

- Nwokoro NA. An analysis of banks credit and agricultural output in Nigeria: 1980-2014. Int J Finance Econ. 2017;5(1):54-66.

- Okuneye BA, Ajayi FD. Commercial banks credit, government expenditure and agricultural output in Nigeria: An error correction model. J Soc Sci. 2019;7(1):73-82.

- Oladapo F, Adefemi AO. Sectorial allocation of banks credit and economic growth in Nigeria. Int J Acad Res Bus Soc Sci. 2015;5(6):161-9.

- Oyakhilomen O, Omadachi UO, Zibah. Cocoa production-agricultural credit guarantee scheme fund nexus in Nigeria: A Co-integration approach. Russ J Agric Soc Econ Sci. 2012;9(9):28-32.

- Rehman A, Chandio AA, Hussaine I, et al. Is credit the devil in the Agriculture? The role of credit in Pakistans agricultural sector. J Financ Data Sci. 2017;3:38-44.

- Ubesie CM, Echekoba FN, Chris-Ejiogu UG, et al. Sectoral allocation of deposit money banks credit and the growth of Nigerian real economy: A disaggregated analysis (2008q1–2017q4). Int J Econ Manag. 2019;22(1):1-22.

- Udih M. Bank credits and agricultural development: Does it promote entrepreneurship performance? Int J Bus Soc Sci. 2014;5(11):102-107.

- Udoka CO, Mbak OD, Duke BS. The effect of commercial banks credit on agricultural production in Nigeria. J Finance Account. 2016;4(1):1-10.