Research Article - Journal of Finance and Marketing (2025) Volume 9, Issue 4

SEBI's regulatory blind spots: Critical analysis of unchecked penny stock manipulation in the Indian market.

Rithik Dhariwal*, Mitali Srivastava

Department of Law, CHRIST (Deemed to be) University, Delhi NCR, Ghaziabad, India

- Corresponding Author:

- Rithik Dhariwal

Department of Law,

CHRIST (Deemed to be) University,

Delhi NCR, Ghaziabad,

India

E-mail: rithik.j@law.christuniversity.in

Received: 03-Apr-2024, Manuscript No. AAJFM-24-131332; Editor assigned: 05-Apr-2024, AAJFM-24-131332 (PQ); Reviewed: 19-Apr-2024, QC No. AAJFM-24-131332; Revised: 07-Jul-2025, Manuscript No. AAJFM-24-131332 (R); Published: 14-Jul-2025, DOI: 10.35841/AAJFM.9.4.286

Citation: Dhariwal R, Srivastava M. SEBI's regulatory blind spots: Critical analysis of unchecked penny stock manipulation in the Indian market. J Fin Mark. 2025;9(4):286

Abstract

This research paper provides a comprehensive analysis of the unchecked price manipulation of penny stocks within the Indian stock market i.e., prominent facilitators NSE and BSE, attributing this issue to the regulatory oversight of the Securities and Exchange Board of India (SEBI). Penny stocks, often characterized by low market capitalization and trading at nominal prices, have been prone to price manipulation, leading to detrimental consequences for retail investors and market integrity. The researcher investigates SEBI's role and effectiveness in preventing price manipulation in the penny stock segment and highlights the inadequacies in the existing regulatory framework. It explores case studies of price manipulation schemes involving penny stocks and the impact of these schemes on investors' confidence in the Indian stock market and the research incorporates a comparative analysis between the regulatory approaches of SEC and SEBI, offering valuable insights into differing methodologies and potential areas for improvement. Furthermore, the researcher offers recommendations and potential regulatory reforms to address the identified shortcomings in SEBI's oversight of penny stocks. These suggestions include enhanced surveillance measures, stricter disclosure requirements, and measures to ensure greater transparency and investor protection.

Keywords

Penny stocks, Indian stock market, NSE, BSE, Securities and Exchange Board of India (SEBI), Market integrity, Retail investors, Price manipulation.

Introduction

The Indian stock market, a dynamic arena for investment, has witnessed a recurring concern regarding the unchecked price manipulation prevalent within the penny stock segment. Penny stocks, characterized by their low market capitalization and nominal trading prices i.e., up to Rs.10, have emerged as a focal point of regulatory scrutiny due to their susceptibility to various manipulative schemes. Despite the vigilant oversight of the Securities and Exchange Board of India (SEBI), these stocks continue to pose challenges to market integrity and investor confidence.

Penny stocks, often trading at fractional prices and exhibiting volatile price movements, attract investors seeking high returns within a short timeframe [1]. However, their inherent characteristics also make them vulnerable to exploitation by unscrupulous actors engaging in price manipulation schemes. These schemes, including pump-and-dump, insider trading, and circular trading, undermine the fairness and transparency of the market, posing significant risks to retail investors.

Established in 1992, SEBI plays a pivotal role in regulating India's securities market, with a mandate to ensure investor protection, maintain market integrity, and facilitate the orderly development of the market. Under the securities and exchange board of India Act, 1992, SEBI was granted extensive powers to oversee and regulate the securities market in India. This legislation marked a significant milestone, providing SEBI with authority to enforce regulatory measures aimed at curbing market malpractices.

The subsequent amendments to the SEBI Act, including the SEBI (Amendment) Act, 1995, and the securities laws (Amendment) Act, 2014, further strengthened SEBI's regulatory framework and clarified its mandate in combating price manipulation. These legislative measures empowered SEBI to enhance market surveillance, impose stricter penalties for market violations, and bolster investor protection measures. Despite the regulatory advancements, challenges persist within the penny stock segment, raising questions about SEBI's regulatory efficacy in addressing price manipulation.

Let's explore the story of XYZ ventures, a penny stock company that became entangled in a scheme of price manipulation. Manipulators targeted XYZ ventures by spreading misleading information, creating a false sense of excitement about the company's prospects through social media and online forums. This deceptive hype led to a surge in the stock price, known as the "pump" phase. Seizing this opportunity, manipulators then swiftly sold off their shares at the inflated price, causing a crash in the stock value—the "dump." Unfortunately, many unsuspecting investors, drawn in by the artificial excitement, suffered losses as the stock's true value did not align with the manipulated price. This case highlights the risks associated with penny stocks and the challenges regulators like the Securities and Exchange Board of India (SEBI) face in detecting and preventing such manipulative activities. As we delve into the specifics, we'll uncover the tactics used, the impact on XYZ ventures, and the broader implications for the world of penny stocks.

In the following sections, we will explore the mechanisms employed by unscrupulous actors to manipulate penny stock prices and investigate the impact of these activities on the broader financial market and investor confidence. Subsequently, we will discuss proposed measures and reforms that could mitigate the unchecked price manipulation of penny stocks, ultimately fortifying SEBI's role as a safeguard for India's financial markets.

Scope of the study

This study's scope encompasses a comprehensive examination of SEBI's regulatory framework concerning manipulation of penny stock prices in the Indian securities market.

Materials and Methods

Guilin Jiang, et al. has discussed the various forms of market manipulation, which include stock price manipulation, and evaluates the efficacy of regulatory measures in curbing such practices [2]. It provides insights into the challenges faced by regulatory bodies and offers recommendations for strengthening their frameworks. The author has failed to describe the manipulation of the penny stocks.

Sankalp Jain he discussed how SEBI (Prohibition of insider trading) regulations were framed to protect the interest of the investors [3]. SEBI has been given wide powers to protect the interests of investors and in the interests of the securities market SEBI should be given more powers to probe insider trading and other market manipulations such as powers to summon phone call records, emails and SMS of persons it is probing for insider trading and other market manipulations. With these powers, SEBI can prevent black money coming into the market as well as keep an eye on insider trading with greater efficiency. SEBI should also introduce the concept of giving away bounties or rewards so as to lead to a decline in this practice by inducing fear in the minds of insiders of being exposed.

Allen and Gorton in his article they considered a trade-based manipulation model. In each equilibrium of their model, the uninformed manipulator makes zero profit, while the informed manipulator repeatedly purchases stocks, causing a large impact on prices, and sells with little effect to earn a profit. The authors conclude that manipulation is due to asymmetry between buy orders and sell orders.

Taoufik Bouraoui, et al. discussed the penny stock markets has shown that stock spasms caused a positive and significant impact on trading volumes and volatility, respectively [4]. The aim of this study is to examine the impact of this information-based manipulation on liquidity. The implementation of an event study methodology exhibits significant positive abnormal liquidities for stocks targeted by manipulators

Kanishka Gaggar has focused upon the penny stocks and about their market capitalization, liquidity and shares strength [5]. It was laid down that these stocks are highly vulnerable towards manipulation.

Huang, et al. look at the penny stocks returns in the US from July 2001 to December 2010 (post-decimalization period) [6]. They find that using CRSP and COMPUSTAT data they compile and quantify the characteristics of penny stocks on NASDAQ, AMEX and NYSE. They find out that penny stocks witness high raw returns, high BM ratio (low price/book ratio), and low liquidity. They also state that 23% of the ownership of listed penny stocks is vested with institutional investors. This becomes a motivation for them to study penny-stocks more carefully. The penny stocks with high levels of institutional ownership do earn abnormally higher returns than those without it.

Pavabutr Pantisa, et al. investigated the nature of Asian penny stocks and benchmark it to NASDAQ penny stocks [7]. They study data for 2007 from twelve countries belonging to the Asia Pacific: Australia, China, Hong Kong, Indonesia, Japan, Korea, Malaysia, New Zealand, Singapore, Taiwan and Thailand. A key finding of this study is that unlike NASDAQ, liquidity does not decline monotonically with price in Asian markets.

Bradley, et al. discussed that “IPO researchers routinely screen out lower-priced issues and, as a consequence, penny stock IPOs have been largely ignored in the IPO literature” [8]. Using a sample of 251 penny stock IPOs and 2,707 ordinary IPOs from 1990-1998, they find that higher initial returns for penny stock IPOs are primarily related to their low offer price. Also, in the long-run penny stocks IPOs underperform ordinary IPOs. Operate in an environment that poses little real risk or cost-financial or otherwise-to themselves while the funds of thousands, potentially millions, of ordinary investors are continually drained away by the promoters' fraudulent schemes.

Research objectives

• To examine the characteristics of penny stocks and analyze how these attributes make them susceptible to price manipulation in financial markets.

• To investigate the common tactics employed in the manipulation of penny stock prices and assess their impact on market integrity and investor confidence.

• To evaluate SEBI's regulatory framework for penny stocks, including its provisions, mechanisms, and enforcement strategies, in deterring and detecting market manipulation.

• To identify and analyze empirical evidence of manipulated penny stocks in the Indian stock market, focusing on their financial performance, trading patterns, and regulatory compliance.

Research questions

• What are the key characteristics of penny stocks that make them vulnerable to price manipulation, and how do these attributes differ from other segments of the financial market?

• What are the various tactics used in manipulating the prices of penny stocks, and how do these tactics affect market stability and investor trust?

• How does SEBI's regulatory framework address the challenges posed by penny stock manipulation, including its provisions, surveillance mechanisms, and enforcement strategies? • What empirical evidence exists regarding the manipulation of penny stocks in the Indian stock market, and how do factors such as trading volumes, financial performance metrics, and regulatory compliance contribute to identifying manipulated stocks?

Hypothesis

H.1: The regulatory framework established by the Securities and Exchange Board of India (SEBI) for penny stocks is ineffective in detecting and preventing market manipulation, leading to increased instances of price manipulation and affecting investors rights.

H.2: SEBI's regulatory framework for penny stocks can be strengthened through enhanced surveillance mechanisms, stricter enforcement actions, and improved transparency, resulting in a more resilient and trustworthy Indian stock market.

This study will employ a mixed-methods approach. It will involve quantitative analysis of SEBI's regulatory data and qualitative analysis. Quantitative data will be statistically analyzed, and qualitative data will be thematically analyzed. A comparative analysis will be conducted between SEBI's framework and the SEC's regulations.

Penny stocks and price manipulation

In the intricate domain of financial markets, the nexus between penny stocks and price manipulation stands as a focal point of investigation and concern. Penny stocks, characterized by their nominal market prices, often become susceptible to various forms of manipulation that can adversely impact market integrity and investor confidence [9]. This paper delves into the nuanced dynamics between penny stocks and the manipulation of their prices, aiming to unravel the underlying mechanisms employed by market participants. As these stocks typically exhibit higher volatility and lower liquidity, they become breeding grounds for unscrupulous practices such as pump-and-dump schemes and other market manipulations.

Characteristics of penny stocks

The researcher scrutinized the distinctive features that characterize penny stocks, a unique segment within financial markets distinguished by several key attributes. At the forefront is their low market price, typically below a specified threshold, with INR 5 commonly considered in the Indian context. This characteristic sets the stage for an exploration into the nuanced dynamics of penny stocks, encompassing their small market capitalization, high volatility, and limited liquidity. As a result, these stocks are often perceived as higher-risk, speculative investments, appealing to certain investors seeking potential gains but also exposing them to substantial losses.

The limited liquidity of penny stocks, stemming from their smaller market capitalization, adds complexity to trading, as bid-ask spreads can be notably higher. This liquidity constraint is accompanied by reduced regulatory oversight, creating an environment where fraudulent activities and misinformation can impact stock prices [10]. Furthermore, the inherent riskiness of penny stocks is underscored by their susceptibility to manipulation, exemplified by practices like "pump and dump" schemes.

Another salient aspect is the comparatively limited information available about penny stocks and the companies they represent. This lack of transparency arises from reduced regulatory requirements, limiting the disclosure obligations of these companies. Additionally, the relatively small market capitalization of penny stocks often results in diminished attention from financial analysts and mainstream media, further contributing to the information gap for investors.

Common tactics used in price manipulation of penny stocks: Within the realm of penny stocks, price manipulation manifests through a spectrum of tactics that exploit the unique vulnerabilities inherent to these low-priced securities. This exploration delves into several common tactics employed in the price manipulation of penny stocks, shedding light on the intricate schemes that jeopardize market integrity and investor confidence [11].

| Tactics | Description | Mechanism |

| Pump and dump | The pump-and-dump scheme orchestrates an artificial inflation of a penny stock's price through deceptive positive statements, only to be followed by a calculated sell-off, leading to a sudden price collapse | Promoters utilize aggressive promotional campaigns, social media, and misinformation to induce a buying frenzy, orchestrating a volatile price surge before executing strategic sell-offs |

| Churning | Churning, or "scalping," involves relentless and excessive trading of a penny stock to create an illusion of heightened market activity | Manipulators execute a multitude of buy and sell orders to artificially amplify the stock's trading volume, deceiving unsuspecting traders into believing in genuine market interest |

| Painting the tape | The art of "painting the tape" centers on manipulating a stock's trading activity to fabricate a false impression of demand or interest | Manipulators engage in coordinated trading activities, executing trades among themselves to create a façade of heightened market interest and activity |

| False rumors and hype | Manipulators disseminate false rumors or hyperbolic information to artificially boost the reputation and desirability of a penny stock | Through telemarketing or online communication, manipulators convince investors to buy shares, inflating demand and consequently escalating the stock price |

| Matched orders | Manipulators engage in matched orders, executing simultaneous buy and sell orders among themselves to fabricate an illusion of genuine market interest | The goal is to deceive other market participants by simulating authentic trading activity and demand for the stock |

| Front-running | Front-running involves executing orders based on advance knowledge of a large pending order that may impact the stock's price | Manipulators anticipate the forthcoming price movement and trade ahead of it, leveraging insider information to profit from the expected market shift |

| Bear raid | In a bear raid, manipulators intentionally drive down the price of a penny stock by aggressively selling shares short | The manipulators aim to induce panic selling among other investors, creating a precipitous decline in the stock price, allowing them to cover positions at lower levels |

Table 1. Common tactics used in price manipulation of penny stocks.

SEBI’s framework with respect to the penny stocks

The term “penny stocks" is nowhere defined in any Indian enactments which are enforce. Generally, defined as a stock which is traded below a threshold limit i.e., Rs.10 has a value or price of the stock in the market, this is governed by the SEBI act, 1992 and its rules and regulations.

Provisions dealing with manipulation of stock prices: Notably, Section 12A of the SEBI Act prohibits manipulative and deceptive devices, insider trading, and substantial acquisition of securities or control, while Section 15G empowers the regulatory body to issue directions for the effective regulation of the securities market. The SEBI (Prohibition of fraudulent and unfair trade practices relating to securities market) Regulations, 2003, under Regulation 3, further emphasizes the prohibition of fraudulent and unfair trade practices. In the context of insider trading, the SEBI (Prohibition of insider trading) Regulations, 2015, through Regulations 4 and 5, establish a comprehensive framework for preventing unauthorized trading by insiders and delineate a code of conduct for such entities.

Additionally, the SEBI (Substantial acquisition of shares and takeovers) Regulations, 2011, under Regulations 4 and 5, impose restrictions on the acquisition of shares under specific circumstances and outline the conditions for acquiring control. Continuous disclosure requirements, as articulated in the SEBI (Listing obligations and disclosure requirements) Regulations, 2015, further fortify the regulatory framework. A pivotal addition is the SEBI (Prohibition of fraudulent and unfair trade practices relating to the securities market) (Amendment) Regulations, 2019, introducing Regulation 4A, specifically addressing the prohibition of manipulative devices.

Mechanisms and strategies deployed by SEBI

The Securities and Exchange Board of India (SEBI) employs various mechanisms to detect and prevent price manipulation in the Indian stock market. These mechanisms are designed to maintain market integrity, protect investors, and ensure a fair and transparent trading environment. Here are some key components of SEBI's mechanism to detect price manipulation:

Surveillance systems: SEBI operates sophisticated surveillance systems that continuously monitor market activities. These systems use advanced algorithms and data analytics to identify unusual price movements, abnormal trading volumes, and other patterns that may indicate potential manipulation.

Price bands: SEBI imposes price bands on securities to prevent excessive price movements. If a stock's price moves beyond a certain percentage from its previous closing price, trading in that stock is halted for a specified period. This measure helps prevent sudden and sharp price changes that could be indicative of manipulation.

Graded Surveillance Measure (GSM): The graded surveillance measure is a surveillance framework used by SEBI to identify and take preventive measures against abnormal price movements. It involves multiple stages with specific actions triggered based on predefined criteria. As stocks move through different stages of GSM, additional surveillance and restrictions may be imposed.

Additional Surveillance Measure (ASM): ASM is an additional layer of surveillance that may be applied to securities already subjected to GSM and continue to exhibit abnormal price behavior. It includes additional margin requirements and trading restrictions to curb excessive volatility.

Market intelligence: SEBI relies on market intelligence and information from various sources, including stock exchanges, market intermediaries, and other regulatory bodies. Unusual trading patterns or activities that are reported or identified through these channels may trigger further investigation.

Periodic inspections and audits: SEBI conducts periodic inspections and audits of market participants, including stock exchanges, brokerage firms, and listed companies. These inspections help ensure compliance with regulatory norms and identify any irregularities or manipulative practices.

Whistleblower mechanism: SEBI has a whistleblower mechanism that encourages individuals to report any instances of market manipulation or insider trading. Whistleblower complaints are treated with confidentiality, and appropriate actions are taken based on the information provided.

Coordination with exchanges and other regulatory bodies: SEBI collaborates closely with stock exchanges and other regulatory bodies to share information and coordinate efforts in monitoring and regulating the securities market. This collaborative approach helps address potential gaps in oversight.

Empirical analysis of manipulated penny stocks

The researcher by delving into trading volumes, financial performance metrics, regulatory compliance, and corporate governance practices seeks to identify the stocks which are manipulated by high volatility and low trading volumes.

Fundamental analysis of penny stocks

Gita Renewable Energy Limited: Gita Renewable Energy Limited generates power from renewable resources including wind, solar and hydro with the end and intent of realigning the business operations undertaken by Kanishk Steel Industries Limited listed on BSE.

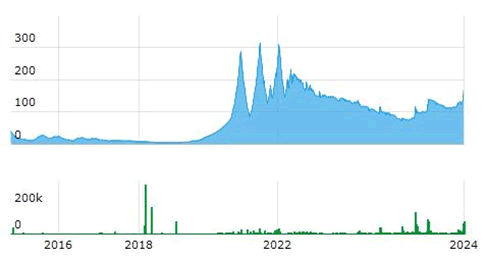

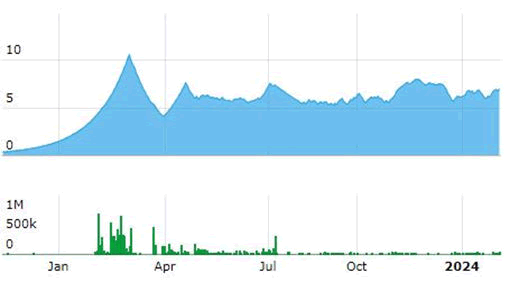

Figure 1. Gita Renewable Energy Limited generates power from renewable resources including wind, solar and hydro.

Currently trading at Rs.175.15, Gita Renewables' three-year trading history exposes stark instances of market manipulation. Despite stagnant growth and annual losses, the stock experienced a surge from Rs.5 to Rs.295 from January 2021 to December 2023, indicative of a pump-and-dump scheme. This surge, characterized by continued upper circuits and low trading volumes, suggests orchestrated price inflation to entice investors, only for manipulators to sell off at inflated prices for substantial returns. Such manipulation tactics, evident through controlled market movements with minimal shares being bought and sold, undermine market integrity and pose significant risks to investors.

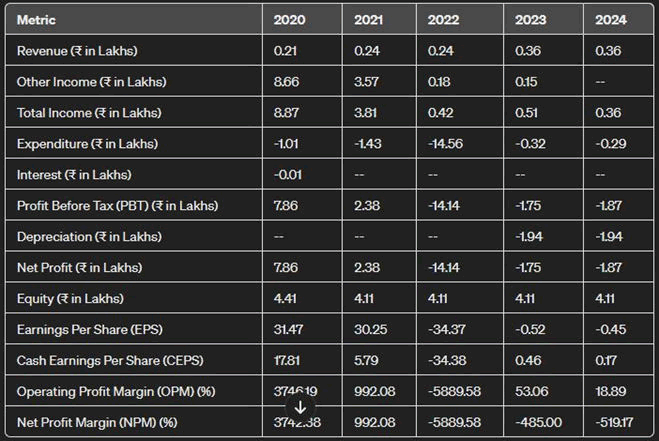

Figure 2. Revenue metrics 2020-2024.

Source: www.bseindia.com

The analysis of Gita Renewables, a penny stock with a face value of Rs10.00, reveals potential manipulation amidst nominal turnover (Rs3.92 lakhs) and market capitalization (Rs71.27 crores full, Rs21.38 crores free float). Despite its small size, Gita Renewables exhibits an excessively high price-to-earnings ratio (475.11), erratic Earnings Per Share (EPS) (Rs0.36 TTM), and negative profit margins. The revenue fluctuates between Rs0.21 lakhs to ?0.36 lakhs over the past years, with significant deviations in Operating Profit Margin (OPM) and Net Profit Margin (NPM). Such anomalies, coupled with the lack of fundamental basis for extreme price movements, raise suspicions of artificial manipulation.

Shri Ganga Industries: A reputed manufacturer and supplier of industrial packaging products. Their catalog of products includes BOPP tape (Plain coloured and printed), foam tapes, cloth tapes, PVC shrink (Rolls and pouches), L.D.H.M. listed on BSE.

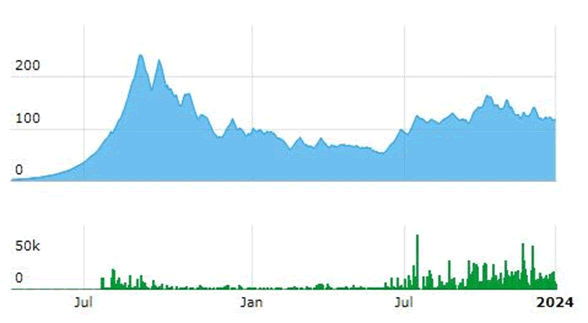

Figure 3. Shri Ganga Industries packaging catalog of products.

The analysis of Shri Gang Industries and Allied Products Ltd.’s has the current price of Rs.101.15 as of 2nd February 2024 where, recent price movements suggest significant manipulation, as evidenced by the stock's rapid ascent from Rs.5 in April 2022 to Rs.234 in August 2022, representing nearly a 5000% return in a short period. This surge was followed by a steep decline to Rs.65 in April 2023 and then to Rs.123 in November 2023, indicating substantial volatility and likely manipulation through pump-and-dump tactics.

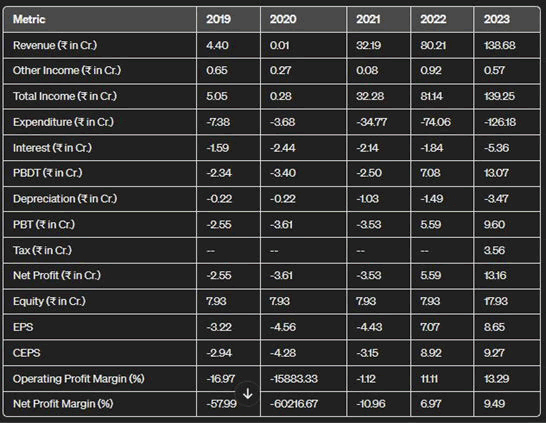

Figure 4. Revenue metrics 2019-2023.

Shri Gang Industries and Allied Products Ltd.’s financial data paints a picture of turbulence, characterized by erratic revenue and profitability. Despite experiencing a surge in revenue from Rs0.01 Cr. in 2020 to Rs138.68 Cr. in 2023, the company's profitability remained inconsistent, with negative figures recorded in 2019, 2020, and 2021, before turning positive in 2022 and 2023. This volatility is reflected in the dramatic swings of the Operating Profit Margin (OPM) and Net Profit Margin (NPM) from extreme negative values in 2020 and 2021 to positive values in 2022 and 2023. Furthermore, the fluctuations in Earnings Per Share (EPS) and Cash Earnings Per Share (CEPS) underscore the company's unstable performance. Despite these challenges, Shri Gang Industries and Allied Products Ltd.’s market capitalization experienced growth, reaching Rs181.36 crores full and Rs114.26 crores free float in 2023, indicating either investor optimism or potential overvaluation. However, the company's negative Return On Equity (ROE) of -65.90% highlights inefficiencies in generating returns from shareholders' equity, raising concerns about its long-term sustainability.

Softrak Ventures Investments: It accelerates the journey to cloud computing, helping offices to store, manage, protect and analyze their most valuable asset-information-in a more agile, trusted and cost-efficient way, listed on BSE.

Figure 5. Softrak Ventures Investments journey to cloud computing.

Softrak ventures investments has experienced significant price volatility, with its stock rising from Rs.0.56 in April 2022 to Rs.1.55 in December 2022, representing a nearly 200% return in a short period. Subsequently, the stock price surged to Rs.11.15 in February 2023, marking an approximate 2000% return before settling at the current trading price of Rs.11.70. These sharp fluctuations indicate potential manipulation through pump-and-dump schemes, as shareholders artificially inflate prices before selling off for substantial gains. Fundamentally, the company's financials reveal minimal revenue and negligible profits annually, with no clear prospects for future growth. Investors should approach investments in Softrak Ventures Investments with caution, considering the high volatility and lack of sustainable fundamentals.

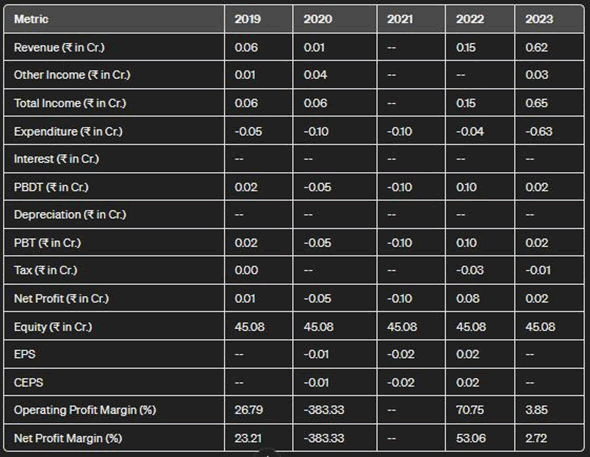

Figure 6. Revenue metrics 2019-2023.

Softrak Ventures Investments displays a concerning financial profile marked by minimal turnover (Rs0.18 lakhs) and a modest market capitalization of Rs5.39 crores. Despite its small size, the company exhibits an alarmingly high price-to-earnings ratio of 2400.99, suggesting potential overvaluation. Financial performance indicators such as revenue and profitability depict erratic trends, with revenue increasing from Rs0.01 Cr. in 2020 to Rs0.62 Cr. in 2023, yet profitability fluctuating, resulting in negative net profit margins in previous years. With limited data on earnings per share and cash earnings per share, coupled with a low return on equity of 0.04%, Softrak Ventures Investments presents uncertainties regarding its operational efficiency and long-term sustainability. Investors should exercise caution and conduct thorough analysis before considering investments in this company.

Challenges faced by SEBI in preventing market manipulation

The Securities and Exchange Board of India (SEBI), tasked with overseeing and regulating Indian stock markets, grapples with significant challenges in its efforts to curb market manipulation. A primary obstacle lies in its limited resources, as SEBI operates as a relatively small entity amidst the vast and complex landscape of the Indian stock market. The sheer magnitude of this financial ecosystem makes real-time monitoring and detection of market manipulation a formidable task, exacerbated by dependence on stock exchanges for potentially incomplete and delayed market data. This resource constraint hampers SEBI's ability to promptly respond to instances of market irregularities.

Compounding the issue is the weakness within the legal framework governing the Indian securities market. While SEBI possesses investigative and penalizing powers, the laws lack the necessary rigor to effectively deter market manipulators. Insider trading laws are notably lax, and penalties for market manipulation are insufficient to instill fear among potential wrongdoers. This legal framework's weaknesses make it challenging for SEBI to take stringent actions against those involved in market manipulation.

Criticism has also been directed at SEBI for its delayed response time to market manipulation. Despite having the authority to act swiftly, the initiation of investigations and subsequent actions often takes an extended period. This delay provides manipulators with a window of opportunity to cover their tracks and escape punitive measures, undermining the overall efficacy of SEBI's enforcement actions.

The prolonged legal processes in India further impede SEBI's efforts. Cases related to market manipulation can linger in the courts for years, resulting in delayed justice and reduced deterrence for potential wrongdoers. The cumbersome legal procedures hinder the timely resolution of cases, diminishing the effectiveness of SEBI's enforcement efforts.

Another challenge arises from the lack of seamless coordination between SEBI and other regulatory bodies overseeing different segments of the financial market. The absence of cohesive collaboration with entities such as the Reserve Bank of India (RBI) and the Insurance Regulatory and Development Authority (IRDAI) creates regulatory gaps that can be exploited by market manipulators.

Conclusion

In the intricate domain of financial markets, the nexus between penny stocks and price manipulation stands as a focal point of investigation and concern. Penny stocks, characterized by their nominal market prices, often become susceptible to various forms of manipulation that can adversely impact market integrity and investor confidence. This paper delves into the nuanced dynamics between penny stocks and the manipulation of their prices, aiming to unravel the underlying mechanisms employed by market participants. As these stocks typically exhibit higher volatility and lower liquidity, they become breeding grounds for unscrupulous practices such as pump-and-dump schemes and other market manipulations.

The researcher scrutinized the distinctive features that characterize penny stocks, a unique segment within financial markets distinguished by several key attributes. At the forefront is their low market price, typically below a specified threshold, with INR 5 commonly considered in the Indian context. This characteristic sets the stage for an exploration into the nuanced dynamics of penny stocks, encompassing their small market capitalization, high volatility, and limited liquidity. As a result, these stocks are often perceived as higher-risk, speculative investments, appealing to certain investors seeking potential gains but also exposing them to substantial losses.

The limited liquidity of penny stocks, stemming from their smaller market capitalization, adds complexity to trading, as bid-ask spreads can be notably higher. This liquidity constraint is accompanied by reduced regulatory oversight, creating an environment where fraudulent activities and misinformation can impact stock prices. Furthermore, the inherent riskiness of penny stocks is underscored by their susceptibility to manipulation, exemplified by practices like "pump and dump" schemes.

Another salient aspect is the comparatively limited information available about penny stocks and the companies they represent. This lack of transparency arises from reduced regulatory requirements, limiting the disclosure obligations of these companies. Additionally, the relatively small market capitalization of penny stocks often results in diminished attention from financial analysts and mainstream media, further contributing to the information gap for investors.

References

- Bhattacharyya A, Chandra A. The cross-section of expected returns on penny stocks: Are low-hanging fruits not-so sweet?. SSRN, Elsevier Inc. 2016.

- Jiang G, Mahoney PG, Mei J. Market manipulation: A comprehensive study of stock pools. J Financ Econ. 2005;77(1):147-70.

- Jain S. Insider Trading in Indian market: Legal and regulatory framework. SSRN, Elsevier Inc. 2015.

- Bouraoui T, Mehanaoui M, Bahli B. Stock spams: Another kind of stock prices manipulation. J Appl Bus Res. 2013;29(1):79.

- Gaggar K. Penny stocks in India. SSRN, Elsevier Inc. 2017.

- Huang W, Liu Q, Rhee SG, et al. Return reversals, idiosyncratic risk, and expected returns. Rev Financ Stud. 2010;23(1):147-68.

- Pavabutr P, Rhee G, Sirodom K, et al. Asian pennies are not like US pennies. DBJ Discussion Paper Series. 2014:1402.

- Bradley DJ, Cooney Jr JW, Dolvin SD, et al. Penny Stock IPOs. Financ Manage. 2006;35(1):5-29.

- Urba?ski S, Jawor P, Urba?ski K. The impact of penny stocks on the pricing of companies listed on the Warsaw Stock Exchange in light of the CAPM. Folia Oecon Stetin. 2014;14(2):163-78.

- Bartels KC. "Click here to buy the next Microsoft": The penny stock rules, online microcap fraud, and the unwary investor. Ind LJ. 2000;75(1):353-77.

- Fox MB, Glosten LR, Rauterberg GV. Stock market manipulation and its regulation. Yale J Reg. 2018;35(1):67-126.