Review Article - Journal of Finance and Marketing (2017) Volume 1, Issue 1

Improving efficiency and reducing fraud in UAE's health insurance market.

Niyi Awofeso*

Department of Health Care Management, School of Health and Environmental Studies, Dubai, UAE

- *Corresponding Author:

- Niyi Awofeso

Department of Health Care Management

School of Health and Environmental Studies

Hamdan Bin Mohammed Smart University

P. O. Box 71400 Dubai

United Arab Emirates

Tel: +97144241018

E-mail: a.awofeso@hbmsu.ac.ae

Accepted date: December 19, 2017

Citation: Awofeso N. Improving efficiency and reducing fraud in UAE’s health insurance market. J Fin Mark. 2017;1(1):7-16.

DOI: 10.35841/finance-marketing.1.1.7-16

Visit for more related articles at Journal of Finance and MarketingAbstract

The World health report 2010 estimated that about 20-40% of all health sector resources are wasted and highlighted health care leakages-waste, corruption and fraud-as the ninth leading source of inefficiency of health systems. The health care system of the United Arab Emirates (UAE) is currently ranked 9th out of 55 nations assessed by the Bloomberg’s health care efficiency index-the United States of America ranks 50th. However, if efficiency is defined conventionally based on costs to achieve specified outcomes, the UAE health system has efficiency shortcomings in relation to health care costs by its citizens for overseas medical treatment as well as the per patient cost of treating diabetes annually-as high as $10,000 annually per Emirati citizen with complicated diabetes. One approach to improving efficiency of UAE’s current AED64 billion ($17 billion) annual health industry market is through universal health insurance, as it facilitates improvements in health outcomes by making access to high-quality health services more affordable and equitably distributed. The European Health Care Fraud and Corruption Network stated that, in 2008, of the annual global health expenditure of about US$ 5.3 trillion, at least 5% or about US$ 260 billion, is lost to fraud. According to 9 March 2016, UAE Gulf News report, AED 4 (11%) billion of the AED33 billion health insurance claims by individuals and health care providers are related to health insurance abuse and fraud. Using the newly implemented Dubai Mandatory Health Insurance Program as case study, this article critically reviews opportunities to improve the efficiency of UAE’s health insurance system and highlights approaches to tackling health insurance fraud and abuse, which adversely affect the efficient delivery of health services in UAE

Keywords

Efficiency, United Arab Emirates, Health insurance, Fraud.

Introduction

Optimizing efficiency in health care delivery is one of the core functions of healthcare policy makers. For example, in the United States, whose 2.7 trillion annual health budget accounts for about a third of total global health care spend, it is estimated that $700 billion is spent on care that do not improve health care outcomes [1]. Efficiency entails using health care dollars to get the best value for money or as the US Institute of Medicine [2] describes it; Avoiding waste, including waste of equipment, supplies, ideas and energy. In economics, three common perspectives on efficiency are; Technical efficiency-means that the same level of the output cannot be produced with fewer of the inputs; Allocative efficiency-allocating resources in such a way as to provide the optimal mix of goods and services to maximize the benefits to society; Social (or Pareto) efficiency-exists when no one can be made better off without making someone else worse off. It is noteworthy that an allocatively efficient situation may be inequitable. Similarly, moving from an inequitable to an equitable distribution of resources can be suboptimal from the perspective of allocative efficiency.

Efficiency is essential for the sustainability of health systems. The 2010 World Health Report [3] posited that 20%-40% of healthcare resources are wasted. For example, reducing unnecessary expenditure on medicines and enhancing quality control can save countries 3%-5% of their total health expenditure. As countries move towards universal health coverage via health insurance, health insurance abuse and fraud pose further threats to improving efficiency. The 2010 World Health report [3] posits that health system leakages because of fraud, abuse or corruption constitute one of the 10 leading causes of inefficiency of health care systems. An inadequate or doctor-heavy mix of health workers, hospitalcentric infrastructure and health services that fail to meet population needs are other sources of inefficiency. Inadequacy of residential nursing homes and other long-term rehabilitation facilities may result in, expensive long hospital stays. Limited transparency and accountability, poor salaries may result in waste, corruption and theft of health services properties.

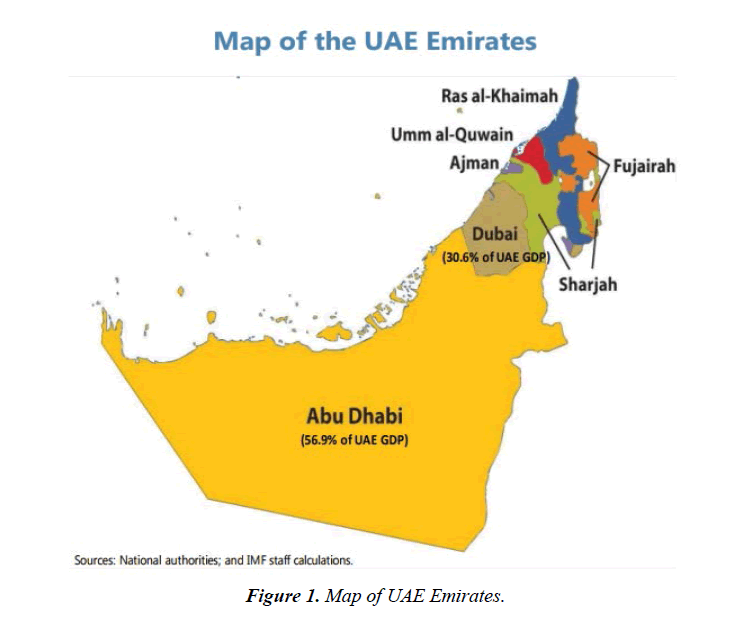

The United Arab Emirates (UAE) is a federation of seven Gulf Emirates: Abu Dhabi, Ajman, Dubai, Fujairah, Ras al- Khaimah, Sharjah and Umm al-Qaiwain (Figure 1).

The UAE is ranked 42 in the Human Development index list for 2016 [4], with a score of 0.84. Current life expectancy at birth is 77.6 years and public health expenditure as percentage of GDP is 2.6%. At the federal level, the two most important health regulatory authorities are the Ministry of Health and prevention and the insurance authority. The Insurance Authority, which was established under Federal Law No. 6 of 2007, regulates and supervises the insurance sector in the UAE. At the Emirate level, the notable regulatory agencies are the Department of Health-Abu Dhabi (DoHAD) and Dubai Health Authority (DHA). The UAE spends $17 billion of the estimated $80 billion annual government health spending (and $125 total health spending) on health care. Haidar Al Yousuf, the head of funding at the Dubai Health Authority, estimates that 20-50% of the total spending on health care wasted due to inefficiencies such as needless medical tests and over-prescription of drugs [5].

The relationship between health care spending and health care outcomes weaken significantly after UAS1000 per capita. The United States, for example, spends far more than any other nation on health care both in total expenditure ($3.3 trillion or $10,348 per person in 2016), but ranks a low 50 out of 55 in Bloomberg’s 2016 health system efficiency scorecard [6]. The United States also lags behind several OECD nations with lower health expenditure on major health indicators such as life expectancy and maternal mortality. Data from the 2015 Population Survey reveals that 9.1 percent of the U.S. population or 29 million people were uninsured for health care in 2015, which is among the highest uninsured proportions for health care in the OECD [7].

This article reviews opportunities for improving efficiency of health services in UAE and for reducing health insurance fraud, using the Dubai mandatory health insurance scheme as case study.

Improving Efficiency of UAE’s Health System

The Bloomberg’s health systems efficiency index has consistently ranked UAE among the top 10 of 55 leading health care systems studied since 2013 [6]. Efficiency in the Bloomberg report is calculated based on three variables:

Relative health expenditure-This is the amount spent in a given country on medical care vis-à-vis the country’s total Gross Domestic Product (GDP). This factor accounts for 30% of the rating. For UAE, it was 3.64% in 2016. Absolute health expenditure-This is the amount, on average, that people in each country spend on medical costs. To arrive at this number, Bloomberg took each country’s total GDP and multiplied it by relative health expenditure. This factor was weighted to account for 10% of the rating. For UAE in 2016, it was $1611 per capita. Life expectancy-This is the age that a given person in a country is expected to live on average. This factor accounted for 60% of the rating. For UAE in 2016, it was 77.37 years.

While this alternative measure of efficiency gives credit to UAE’s health system, the UAE’s government expenditure is relatively low compared with the OECD average and average per capita health expenditure is hugely influenced by the nation’s demographic profile-80% are expatriates aged between 20 and 60 years and 69% of all emigrants are predominantly pre-screened healthy males. Thus, it is not surprising that UAE’s per capita health care cost is below the $3,800 OECD average. When the data are disaggregated for expatriates and non-expatriates, per capita health care costs for UAE citizens is estimated at about $6500, about four times the national average. Thus, there is ample room for efficiency improvements in the UAE health sector. The following areas represent ‘best buys’ for such efficiency improvements:

• Standardise and simplify

• Get the most out of technologies and health services

• Motivate health workers

• Improve hospital efficiency

• Get care right the first time by reducing medical errors

• Critically assess what services are needed.

• Eliminate waste, especially those related to health insurance abuse and fraud (subject of case study below).

Standardise and simplify

The UAE hospital services are increasingly high cost. Data from ultra-lean hospital complexes such as Narayana Multi-Specialty Hospital chain in India show that are quality care is achievable at affordable cost. Standardizing clinical workflows by defining best practice, developing and enforcing explicit guidelines and appropriate information technology services constitute important pathways. UAE’s healthcare skill mix is weighted heavily towards high cost medical personnel, with a nurse-doctor ratio of 1.3:1, compared with OECD average of 2.9:1. Changing the skill mix so that highly skilled professionals are only used for their expertise and other workers take the strain of routine care and patient management, enhances efficiency [8].

Get the most out of technologies and health services

Health Technology Assessment (HTA) is an important approach for prioritizing health technology and maximizing the utility of procured equipment and devices. HTA provides a crucial interface between decision makers in health technology development, clinical practice and health systems, bringing them, patients and other key stakeholders together to agree on evidence requirements and then helping develop and evaluate that evidence to support informed decisions by all parties. The objective is to create a common understanding of health needs, the potential of new technologies to address needs and improve outcomes and the need for health systems to adapt to realize those benefits [9]. So far, about $40 million have been invested by the UAE government in Dubai 100 and Dubai Future Accelerators programs, with digital health innovations a top priority. In Dubai, newly introduced technologies such as Robodoc facilitate expansion of the range of medical services available online or over the phone. Dubai Health Authority, which is the first government health organisation in the region to implement telehealth, has placed Robodocs not only in Hatta Hospital’s emergency department but also its 24-hours primary healthcare centres at Al Barsha and Nad Al Hammar, all of which are linked to Rashid Hospital’s Trauma Centre. The Salama electronic health system provides patients and doctors access to medical records through a patient portal and ensure that the electronic patient medical record is available across the DHA health facilities. To date, 1.6 million DHA patient medical records and more than120 million transactions have been transferred to the Salama system.

Motivate health workers

UAE currently has adequate quantity of health workers for its health needs. For example, there are currently 2.53 doctors per 1000 population and 3.16 nurses per 1000 population [10]. Currently, about 85% of the workforce is comprised of expatriates. Financial compensation is a primary motivation for expatriate health workers. While pay for doctors is competitive, pay for nurses and allied health workers generally fall short of levels that will motivate these cadres of health workers. Short-term contracts, ambiguous promotion policies and restrictions on funded continuing professional development activities are well established demotivators of UAE’s expatriate health workers. In the UAE private hospital sector, a portion of the pay for workers is based on performance. Pay for performance has mixed outcomes in improving intrinsic motivation of health workers, but it is a major extrinsic motivator, especially if it is implemented as a hybrid model [11].

Improve hospital efficiency

An organization approach implemented by the UAE for improving the quality and efficiency of hospital services is to mandate that all hospitals and health facilities should seek international accreditation by 2021. Currently about 70% of hospital and health services in UAE are accredited. A 2012 review of efficiency gains in high value hospitals in the United States indicated the following factors are critical;

1. Pursue quality and access and efficiency will improve. Case study hospitals reported that cost reduction was the consequence, not the primary goal, of their efforts.

2. Reinforce goals by addressing organizational culture through communication, clinical leadership, alignment of purpose and celebration of success.

3. Implement quality improvement strategies such as close monitoring of performance indicators against benchmarks to motivate physicians and frontline staff and promote a culture of continuous quality improvement.

4. Use technology including electronic medical records that are customized to the hospital’s configuration and needs as tools to improve quality and efficiency.

5. Manage staffing and adjust roles to reduce or improve handoffs and promote teamwork to meet patient needs, including reassessing traditional boundaries that contribute to faulty handoffs between personnel. Use full-time, on-site physicians such as hospitalists, as well as team leaders, to coordinate services and enhance continuity.

6. Emphasize communication among providers and with families to clarify expectations and improve patient transitions throughout sites of care.

7. Standardize processes and supplies to reduce the opportunity for errors and increase purchasing power.

8. Integrate care, systems and providers, either explicitly in an integrated health system or by adopting the characteristics of an integrated care system within a community for instance, by sharing a common information system [12].

In UAE, hospital efficiency is hampered by inadequate prioritization of employment of qualified hospital administrators. Low bed occupancy (currently about 50%, on average, in hospitals managed by the Ministry of Health and Prevention) and decentralization of expensive hospital services impair efficient healthcare operations.

Gets care right the first time by reducing medical errors

Accessible data on the incidence of medical errors are scarce in the UAE health system. In the United States, medical errors are estimated to be the third common cause of death. Those who survive medical errors deplete scarce health resources that are better utilized by minimization or avoidance of such errors in the first place [13]. In Abu Dhabi emirate, hospitals are required to submit quarterly quality indicators which facilitate monitoring of medical errors and poor-quality care [14]. A just organizational culture which13 focusses on system issues rather than individual failings, as well effective use of variance reporting systems should enhance the objective of minimizing medical errors in the UAE health system.

Critically assess what services are needed

There appears to be a mismatch between the demographic profile of UAE and the prioritization of hospital based care. For example, health care planning based on number of hospital beds required per 1000 population is a flawed metric in UAE given that the share of the population aged 60 or older is only 2.3%. Even with 1.5 hospital beds per 1000 population, the UAE still has an oversupply of hospital beds, as evidenced by 50%-70% hospital bed occupancy rates nationally. A need exists for establishment of facilities longterm conditions, which currently account for a significant proportion of admissions in UAE hospitals. A private facility, Amana Healthcare [15], provides examples of the quality and scope of care required in such facilities. Given the rising prevalence of non-communicable diseases, a greater need exists for health promotion and disease prevention specialist health workers than are currently being recruited.

Health Financing

Health financing is one of the building blocks of health systems. How societies finance health care and the proportion of national resources devoted to health, affects both the level of care different segments of people can get and its quality. There are several established models for implementing health financing functions-national health service systems, social health insurance funds, private voluntary health insurance, community-based health insurance and direct purchases by consumers. These models embody three core health financing principles: Raise enough revenues to provide individuals with basic package of essential services and financial protection against catastrophic medical expenses caused by illness and injury in an equitable, efficient and sustainable manner; Manage these revenues to pool health risks equitably and efficiently; Ensure the purchase of health services in ways that are allocatively and technically efficient. In Rwanda for example, the mutual health insurance scheme currently covers 93% of the population and has been largely successful, given socio-economic constraints, in achieving the above principles [16]. Private, out–of-pocket funding for health services is the most inequitable form of health financing and, unfortunately, the most common mode of health care financing in developing nations [17].

Universal health insurance is regarded by global health agencies as a major positive health transition and a powerful public health concept. As an alternative to out-of-pocket payments, which burden poor people with greater health care needs and impoverish millions every year, well implemented health insurance schemes help spread the costs across whole populations, enabling everyone to pay less for needed health services and reducing the risk of catastrophic healthcare expenses. Such improved financial protection against huge medical bills enable families to save more, increase economic activity and stimulate human and economic development. Universal health coverage is an opportunity but not a guarantee for improved health and human development outcomes-health insurance schemes need to be properly implemented and insulated from inefficiencies like fraud for their benefits to be optimized.

Health insurance fraud is a major source of health system inefficiency in many nations. It may be defined as an intentional act of deception by any person which has as its purpose the objective of: obtaining a (financial or other) benefit or advantage related to the operation of a health insurance scheme; or causing or exposing another person to a (financial or other) loss or disadvantage related to the operation of a health insurance scheme, whether or not that act in fact achieves its intended purpose. From a penal perspective, health care fraud is usually differentiated from health care abuse, defined as an act by any person related to the operation of a health insurance scheme which is not in accordance with the ethical standards and requirement of absolute good faith that should apply to all insurance relationships, but does not include an act which amounts to healthcare insurance fraud [14].

There are many forms of health insurance fraud. Insured persons may perpetuate fraud by misrepresenting the identity of the recipient of care (including the fraudulent use of health insurance cards by someone other than a policy holder to obtain services to which only the policy holder is entitled); modifying medical documents so that someone other than the policy holder receives medical benefits; or/and modifying medical documents so that a policy holder receives benefits for which they are ineligible. Insurance payers may indulge in fraudulent activity by providing monetary incentives to claims reviewers to deny or delay payments; systematically and deceitfully under-valuing the amount owed to a provider with the intent to defraud, and/or; deliberately misstating benefits in marketing materials. Health care providers may engage in fraudulent activities by: soliciting payments or other benefits for providing services to which an individual is not entitled to (i.e. receiving a bribe); improperly billing for healthcare services with the intention to receive financial benefit such as by: billing for services, medicines that were not provided; billing with a reimbursement code for a more complex and expensive procedure than was actually provided; misrepresenting non-covered treatments as medically necessary covered treatments; billing separately for procedures that normally are covered by a single fee; Billing more than once for the same service; using a code number that does not apply to the procedure; colluding with other persons to implement an arrangement that pays for services to which individual recipients are not entitled or which were not in fact provided [14].

The European Healthcare Fraud and Corruption Network estimates that 5% to 10% of the 2012 global $6.5 trillion health industry expenditure is lost to fraud, of which a significant proportion is health insurance fraud. In the United States, which currently expends about $2.7 trillion on health care annually, a national Health Care Fraud and Abuse Control Program (HCFAC) was established under the Health Insurance Portability and Accountability Act of 1996 (HIPAA). The Program is carried out jointly at the direction of the Attorney General and the Secretary of the Department of Health and Human Services (HHS), acting through the Inspector General. The Program aims to coordinate federal, state and local law enforcement activities with respect to health care fraud and abuse. The HCFAC account has returned over $29.4 billion to the Medicare Trust Funds since its inception in 1997 ( $6.10 for each dollar invested), a tip of the iceberg, given estimates that about $68 billion was lost to health care fraud in the United States in 2006 alone, according to the National Health Care Anti-Fraud Association, out of about $700 billion lost to health care fraud and other “wastes”-healthcare spending that can be eliminated without reducing the quality of care [18,19]. In GCC nations, it is estimated that, currently, about $1 billion or 10% of total health insurance claims, is fraudulent [20].

As the GCC health insurance industry is growing rapidly (As at 2014, Bahrain, Kuwait and Saudi Arabia have compulsory universal health insurance, while UAE, Kuwait and Oman are implementing universal insurance policies) and as combined health spending in GCC nations increase to a projected $69 billion by 2020, inefficiencies due to health insurance fraud are likely to worsen unless coordinated and effective health insurance fraud control measures are implemented. The author reviews Dubai’s evolving health insurance system and highlight potential fraud risks. A Risk management framework to facilitate health insurance fraud in Dubai is proposed.

Dubai’s Mandatory Health Insurance Scheme

UAE’s health insurance network and expenditure are growing rapidly, with Dubai’s Mandatory Health Insurance Law 11 of 2013 now fully operational.. The law states that all residents and visitors to Dubai must have a minimum of basic healthcare coverage-Essential Benefits Plan. Dubai’s Statistics Centre estimated the population of Dubai at 2.7 million in 2016, with approximately 70% male and 30% female. The majority of male expatriate residents are blue-collar workers of Asian, South Asian or African origin, with only 13% under the age of 15 years and 2% over 60 years of age [4]. Dubai’s Universal Health Coverage is based on mandatory enrollment through employment and gives health consumers a choice of seeking treatment with government and/or private healthcare providers. Currently, the government owns four Dubai Health Authority (DHA) hospitals with a capacity of 2063 beds and 14 Primary Healthcare Centers. In addition to DHA, the Ministry of Health-Dubai Medical District owns and operates 2 hospitals, with a capacity of 284 beds and 9 PHCs in Dubai. The private sector comprises of 22 hospitals, with a capacity of 1468 beds and over 1000 outpatient clinics and polyclinics. The total bed capacity in Dubai is 3815 beds or 1.9 beds per 1000 population. Dubai’s total health expenditure as percentage of its GDP is 3.4%. In 2012, despite no mandatory health insurance, private insurance expenditure as proportion of total health expenditure in Dubai was high, at 33%. In addition, there are currently 3000 private health facilities in Dubai. Health insurance companies are obliged to comply with all provisions of Dubai’s insurance law including providing any information, data or statistics such as medical file of beneficiary deemed necessary for inspection, to DHA. It is envisaged that total premiums is currently 6.5 billion AED, up from the March 2014 total of 4 billion AED, of which 4.5 billion AED will be contributed by white collar workers [21]. By mid-2017, a total of 4.6 million individuals registered for health insurance coverage in the Emirate of Dubai.

According to DHA [22], in 2012, 9.934 billion AED was spent on health care in Dubai, 5.8 billion of which was spent in Dubai’s private health care sector. The total current expenditure was funded as follows: Government 32%; Employers and corporations 45%, of which 36% of the total expenditure was health insurance prepayments; Households 22%. The major recipients of Dubai’s health care dollars were Hospitals-(48% of total receipts) and clinics/ policlinics-(22%). Based on types of care, curative care received 55%, while Preventive care received 6% and was mainly funded by the government. Interestingly, preventive services accounted for only 1% of health insurance claims. Drugs and other medical goods received 20% of total healthcare funds.

The dual objectives of Dubai’s health insurance scheme are universal access and quality health care provision. The access objective is to be achieved by making health insurance mandatory for all residents and long term visitors to Dubai. The quality objective is to be achieved by accreditation requirements as well as a competitive healthcare market in which patients can choose their preferred providers. The Dubai Government funds the health insurance program for resident UAE nationals as part of the Enaya scheme. Expatriates and their immediate dependents are normally enrolled in health insurance schemes paid for by their employers. It is not permissible for employers to deduct premiums from the employee or to reduce salary to mitigate the cost of health insurance. Employees will have to pay only the deductible or coinsurance amounts specified under the terms of the policy as well as any other treatment costs incurred which are not covered by the policy or which are in excess of any policy limits. Only the 52 insurance companies holding Dubai Health Insurance permits are permitted to enroll health consumers, but they cannot deny coverage or impose special conditions for low income earners. Each year, DHA sets a price range within which participating insurers must set their premium. For 2017, the range of premium for the Essential Benefits Plan was set at between 600 and 750 AED per insured member. Funds are prohibited from charging greater than 25AED above or below the approved band. The Health Insurance Law requires that all medical expenses schemes must be established on a fully insured basis. Annual upper aggregate claims limit for any insurance cover in UAE was set at 150,000 AED for 2017. Health services excluded from insurance claims include healthcare services which are deemed not medically necessary as well as all expenses relating to dental treatment, dental prostheses and orthodontic treatments [23].

To date, no major case of health insurance fraud has been prosecuted in Dubai. In November 2017, revealed that it has fined 25 health centers, clinics, insurance brokers and insurance companies for violating the Dubai mandatory Health Insurance law, while it has referred 6 clinics to prosecution for potential fraudulent activities. Dr. Haidar Al Yousef, the Director of the Health Funding Department at DHA said the fines imposed on these health centers, clinics, insurance brokers and insurance companies ranged from Dh10,000 to Dh80,000. Dr. Al Yousef revealed that the violations include but are not limited to: Healthcare provider altering the diagnosis to get claims paid; Healthcare provider submitting claims for non-performed services; Healthcare provider submit partial case details to get coverage and get claims settled; Beneficiary abuse the health insurance card; Ordering Medical unnecessary services and laboratories [24].

However, there are several reasons to consider Dubai as a high risk community for health insurance fraud. First is novelty. Wide scale health insurance schemes are not yet well established in the Middle East. Thus, there is not enough local experience on fraud prevention and health insurance contexts in OECD nations diverge significantly from that of the UAE [25], making fraud prevention measures more difficult to adapt. Second are demographics. At one end of the spectrum are white collar expatriate staff many of whom are paying more than they should for insured health services partly because they are told by health care providers that they suffer from conditions that they do not have, pay for treatments that they do not need and are kept in hospital for longer than they should be. At the lower end of the spectrum, about 60% of foreign workers in UAE are expatriate manual workers who may be easily manipulated by health insurance companies due to low health literacy and inadequate familiarity with how health insurance works [26]. Third, unlike the situation in most OECD nations, the biggest source of health insurance fraud-health care providers-are privately owned in Dubai. The private health sector accounted for 75.8% of the total outpatient visits and 61.3% of the total inpatients in Dubai’s health system 2012. Given the prime profit motive of private health facilities, the risk of health insurance fraud in private hospitals is greater than in government hospitals which are not-for-profit outfits. Fourth, since Dubai’s insurance law mandates that all approved health care services be insurable, the number and diversity of service providers are likely to increase, creating more opportunities for health insurance fraud.

Risk Management Approach for Health Insurance Fraud Prevention

Despite risk prevention activities being as old as the history of human civilization-organizations and individuals continually seek to identify and reduce risks that threaten their existence-the discipline of health care risk management is less than six decades old. It emerged in the United States in the early 1970s when hospitals experienced rapid escalation of claims costs and subsequently insurance premiums. Health care risk management may be described as the systematic process of using administrative directives, organizations and operational skills and capacities to implement strategies, policies and improved coping capacities in order to lessen the adverse impacts of medical errors, fraud and inefficiencies in the production of healthcare goods and services. Health insurance provision increases the risk of fraud depending on the mix of players and reimbursement mechanisms, such as perverse payment incentives which encourage provision of unnecessary services to patients. The health care market is characterized by asymmetrical information between providers and consumers and this situation increases fraud risk. Among fully insured health consumers (such as most UAE citizens and highly paid expatriates), the risk of fraud is higher since the marginal cost of health services to such consumers is nil. This effect is independent on consumer behavior [27].

An effective risk management program for preventing health insurance fraud has the following structural elements; the approach should include a defined scope of risks to be managed, including an examination of the risks that affect corporate image of health services or those that may adversely affect consumers’ trust and confidence. Risk management approaches should adopt a mix of techniques to prevent or reduce potential losses and preserve organizational assets. Also important are laws, policies and procedures that ensure program uniformity, assist in communicating program content and authorize sanctions. The risk management process consists of five steps:

1. Identify and analyze loss exposure.

2. Consider alternative risk techniques.

3. Select what appears to be the best risk management technique or combination of techniques.

4. Implement selected techniques.

5. Monitor and improve the risk management program [28].

A critical starting point in analyzing health insurance fraud exposure is Risk Analysis-the process of determining the potential severity of loss associated with an identified risk and the probability that such a loss will occur. Risk managers need to give priority to determining the major sources of fraud. Based on audits from the United States, health insurance fraud can be attributed to one of five major categories of perpetrators; Providers and medical professionals; Hospitals and facilities; Consumers and the public; Insurance companies and Third Party Administrators, and; Brokers, agents and employees. Providers and medical professionals account for the majority of fraud or 72 percent, while hospitals and facilities account for over eight percent of all suspected fraud cases according to an America’s Health Insurance Plans (AHIP) survey [29]. Consumers account for 10 percent and the final 10 percent comes from all other sources, including brokers and agents, laboratories, pharmacies and employees. Determination of prevalence of health insurance fraud by perpetrator categories through historical audit of fraud cases is an important step in analyzing fraud exposure.

Established methods of risk identification systems include incident reporting-which uses electronic or paper based data collection processes to provide early warning information about unorthodox health insurance claims or practices and generic occurrence screening-retrospective random review of patients records by claims adjudicators to reconcile claims records with documented clinical care provision. Closed claims data, which reveal the frequency and severity of prior insurance payouts, provide valuable information that may guide current risk profiles.

Risk management techniques refer to the study and choice of feasible approaches for addressing a given risk. Risk control is an important risk management technique for preventing health insurance fraud. Loss prevention is a risk control technique that seeks to reduce the likelihood of a fraudulent event occurring and the frequency of loss. A reliable approach to effective loss prevention is the use of the fraud triangle. This model centers around three key factors present when individuals or organized groups commit fraud: rationalization, opportunity and motivation or pressure [30]. Rationalization for fraud can take many forms but is typically an important stimulus factor. For example, a physician might justify fraudulent practices by a self-belief that big insurers are sitting on piles of money or that the company deserves the loss, having taken in premiums from the poor contributors. Motivation, the perception of a need or a pressure is the key factor and it does not matter whether or not the motivation makes sense to others or is based in reality. For some, the prospect of catastrophic health care expense may be invoked as motivation. Pure greed may also be a factor, but this may be flavored with a sense of injustice, such as fraudulent claims to cover treatment for a condition that the patient believed should have been diagnosed earlier. Opportunities for health insurance fraud occur in environments with little perceived chance of getting caught or penalized. Windows of opportunity exist for health insurance fraud when regulatory health agencies have poor internal controls, weak processes and procedures. An effective health insurance fraud deterrence program should directly target the three elements of the fraud triangle [31].

Selecting and implementing the most appropriate risk management techniques for preventing health insurance fraud entails forecasting the effects that the available risk management options are likely to have on health insurance fraud prevention, as well as prioritizing the adoption of each technique based on feasibility, ease of use and costeffectiveness. Insurance claims for unnecessary use of ultrasound and other imaging investigations which provide little health benefits to patients exemplify an area of fraud that requires effective risk management processes. In the United States in 2007, Medicare health insurance scheme covered about 17 million ultrasound services in ambulatory settings at a cost of $2.1 billion. Using claims audit techniques conducted in accordance with US Quality Standards for Inspections, the US Health Department’s office of Inspector general, which is mandated by Public Law 95-452 to prevent health insurance fraud, undertook claims audit for ultrasound services reimbursed in 2007 and determined that 20 highuse regions accounted for 16 percent of Medicare insurance spending on ultrasound despite having only 6 percent of Medicare beneficiaries. Nearly one in five ultrasound claims nationwide had characteristics that raise concerns about whether the claims were appropriate. The five assessed characteristics were: Absence of a preceding service claim from the ordering physician. This refers to an ultrasound ordered and performed without a preceding Evaluation & Management encounter to generate an ultrasound-addressable question; Use of suspect combinations of billing codes, such as billing for both a complete abdominal scan and a scan of an individual organ within the abdominal cavity; Occurrence of more than five ultrasounds provided to the beneficiary on the same day by the same provider; Beneficiaries who had ultrasounds billed by more than five providers; Missing or invalid ordering physician identifiers. The audit also found that a group of 672 health care providers each billed 500 or more ultrasound claims with questionable characteristics [32].

Organizational structures, Legislations policies and procedures for addressing health insurance fraud are important risk management approaches. In the United States, the Office of the Inspector General in the Department of Health and Human Services undertakes fraud prevention activities through the following component units: (a) The Office of Audit Services, which provides auditing services for the Department’s health insurance sector as part of efforts to help reduce waste, abuse and mismanagement and promote economy and efficiency throughout the Health and Human Services Department; (b) The Office of Evaluation and Inspections, which conducts national evaluations on preventing fraud, waste or abuse and promoting economy, efficiency and effectiveness of departmental programs; (c) The Office of Investigations conducts criminal, civil and administrative investigations of fraud and misconduct related to Health and Human Services programs, operations and beneficiaries. These fraud prevention units are in additional to dozens of health insurance fraud prevention organizations in the public and private sectors. In the United States, when Medicare and Medicaid were enacted in 1965, a single provision prohibited the making of false statements to secure reimbursement. Currently, at least 12 health-carespecific civil, criminal and administrative anti-fraud laws and regulations have been enacted by the states and the federal government (e.g. the 1996 Health Insurance Portability and Accountability Act) to prevent health insurance fraud, providing a wide array of criminal, civil and administrative responses, with a range of punishment from fines to life imprisonment [33].

Health insurance policies facilitate implementation, monitoring and improvement of legislation and provide a framework for compliance. For example, the Abu Dhabi Health 2010 health insurance and abuse policy places health insurance fraud duties (e.g. reporting and policy adaptation) on health insurance companies, third party administrators, healthcare organizations, healthcare professionals, employers and insured persons who participate in the health insurance scheme in Abu Dhabi. Procedures, especially for insurance claims need to be properly detailed to reduce the risk of negligent claims and to facilitate proof of health insurance fraud. In Australia, the Medicare Benefits Schedule Book is a procedure manual that details eligibility for various categories of Medicare (government health insurance) reimbursement to patients and general practitioners [34]. Case studies of sanctions of stakeholders found guilty of Medicare insurance fraud highlight the value of risk management approaches for fraud prevention. For example;

“A Queensland medical practitioner was required to repay about $45 000 to Medicare Australia and was disqualified from prescribing Pharmaceutical Benefits Scheme medicines for three years for inappropriate prescribing of painkillers. The practitioner came to Medicare Australia’s attention when routine analysis of prescribing data showed concerning levels of prescriptions for pain relief medication like pethidine and morphine. Medicare Australia referred the practitioner to the Professional Services Review (PSR) for peer review. The PSR found the practitioner had prescribed subsidised medicine for pain relief to patients where it was not clinically necessary.” [35].

Suggested Strategies for Preventing Health Insurance Fraud in Dubai

With Dubai’s mandatory health insurance scheme progressing towards full coverage by 2016, it is important to develop a risk management approach for health insurance fraud prevention. Professional fraud prevention measures are not as common as opportunistic fraud in the health insurance sector. However, opportunistic fraud is usually more difficult to prevent as perpetrators (e.g. physicians and most employees) do not fit the “criminal” stereotype. It is useful to adopt an overarching risk management framework for fraud prevention instead of the current reactive approach, exemplified by the July 2013 announcement by Dubai Health Authority to set up a regulatory agency to police private hospitals in the Emirate. A health insurance fraud prevention department is required within the Dubai Health Authority to liaise with all stakeholders and provide oversight regarding fraud prevention in public and private health sectors. The department’s roles in relation to audit, supervision and oversight need to be clearly detailed. Second, the potentials of e-claims for fraud detection will remain just that unless there are skilled fraud risk management adjudicators to spot and investigate unusual trends using data analytics software [36]. Examples of data analysis for insurance fraud prevention include; calculation of statistical parameters in claims for specified health service claims (e.g. averages, standard deviations, high/low values) - to identify outliers that could indicate fraud; Classification-to find patterns amongst data elements; Joining different diverse sources-to identify matching values (such as names, addresses and account numbers) where they shouldn’t exist; Duplicate testingto identify duplicate transactions; Validating entry dates-to identify suspicious or inappropriate times for postings or data entry [37].

Dubai’s Health Insurance Law grants powers to Dubai health Authority for regulating the health insurance sector, but the scope and depth of theses powers in relation to fraud prevention are vague. There is a need for publicly available policies and procedures on health insurance fraud, as health consumers may be perpetrators of fraud or find themselves as unwilling participants in fraudulent activities. Procedures for claims need to be properly spelt out. The electronic claims and coding of claims is an important first step already effectively implemented by Dubai health authority. In determining fraud, multiple approaches, including prospective audits and site inspections are usually required and some of these activities are best contracted to competent third part agencies with international experience in health insurance fraud prevention. Accredited health insurance companies in Dubai should also be encouraged to contribute to the formation of a central body for fraud prevention.

Health literacy is an important strategy for fraud prevention in Dubai. Insured health consumers need to be aware of their rights and obligations and report suspicious billing practices. This is especially important for expatriate manual workers who have no prior experience with health insurance operations. White collar workers who have generous insurance schemes may also be unwitting accessories of health care fraud if they are deceived into authorizing bogus insurance claims. Health literacy should utilize multiple channels, including the Dubai Health Authority website, to educate the public about health insurance processes, rights and obligations. In the spirit of transparency, annual compliance case studies, similar to that of Medicare Australia [35] should be published to educate stakeholders about progress, trends and sanctions in relation to health insurance fraud.

Conclusion

Improving efficiency and financial sustainability of health systems implies narrowing the imbalance between the obligations that a health system has in respect of entitlements and instituted rights on the one hand and its ability to meet those obligations on a continuing basis on the other. Threats to financial sustainability of health services is characterized by increases in health spending that due to factors that affect demand and supply of health services, such as technological advances and heightened consumer expectations; resource constraints exemplified by health spending rising steeply as a proportion of GDP. In UAE, measures being put in place to ensure the efficiency and sustainability of health services are paying dividends, but there is ample room for improvement.

With the ongoing implementation of Dubai’s mandatory health insurance scheme comes a requirement to institute appropriate procedures to tackle health insurance fraud, which is estimated to add about 10% in insurance premium charges and make health insurance expensive for many. The current regulatory environment in Dubai is so far not developed enough to address the complexity of professional and opportunistic fraud, particularly in the private health care sector. A risk management approach is a useful overarching framework for developing the organizational structures, workforce, data analytics systems and processes for effective health insurance prevention. As health consumers may be active or unwitting perpetrators of health insurance fraud, it is important that the Dubai Health Authority shares its policies and procedures with consumers by making such documents accessible on its web site. Health literacy among consumers is another aspect of the health insurance fraud prevention equation that requires urgent attention. Given that health care professionals in the United States are the biggest contributors to health care fraud losses, ethics training for Dubai’s health care professionals may require updating to incorporate the private sector health professionals and emphasize the need to avoid acts that tantamount to health insurance abuse or fraud.

References

- Aaron HJ. Waste, we know you are out there. N Engl J Med. 2008;359(18):1865-7.

- Institute of Medicine. Committee on quality of health care in America. Crossing the quality chasm, a new health system for the 21st century. Washington, DC: National Academy Press. 2001.

- World Health Report. Health systems financing: The path to universal coverage. Geneva: World Health Organization. 2010.

- Dubai Statistics Centre. Population by gender and age groups, Emirate of Dubai. 2016.

- Flanagan B. Up to $40 billion of Arab world?s spending on health care wasted. The National. 2015.

- Bloomberg. Most efficient health care systems in the world.

- Roser M. Our World in Data. Link between health spending and life expectancy: US are an outlier. 2017.

- Richman BD, Udayakumar K, Mitchell W, et al. Lessons from India in organizational innovation: A tale of two heart hospitals. Health Affairs. 2008;27:1260-70.

- Facey K, Henshall C, Sampietro-Colom L, et al. Improving the effectiveness and efficiency of evidence production for health technology assessment. Int J Technol Assess Health Care. 2015;31(4):201-6.

- International Monetary Fund. United Arab Emirates-selected Issues. 2017.

- Rusa L, Ngirabega JD, Janssen W. Performance-based financing for better quality of services in Rwandan health centres: 3 year experience. Trop Med Int Health. 2009;14:830-7.

- Commonwealth Fund. Achieving efficiency: Lessons from four top-performing hospitals. Washington DC, Commonwealth Fund. 2012.

- Makari MA, Daniel M. Medical error-the third leading cause of death in the US. BMJ. 2016;353.

- Abu Dhabi Health Authority. HAAD JAWDA quality performance quarterly KPI profile (specialized and general hospitals). 2017.

- Amana Healthcare-Medical and Rehabilitation hospitals.

- Saksena P, Fernandes-Antunes A, Xu K, et al. Mutual health insurance in Rwanda: Evidence on access to care and financial risk protection. Health Policy. 2011;99:203-209.

- The World Bank. Health financing revisited: A practitioner?s guide. Washington DC, World Bank. 2006.

- US Department of Health and Human Services & Department of Justice. Health Care Fraud and Abuse Control Program Annual Report for Fiscal Year 2013. Washington DC. 2014.

- Kelly R. Where can $700 billion are cut from the US health care system? White Paper, Thompson Reuters. Ann Harbor: USA. 2009.

- Ang M. Getting tough on health fraud. Middle East Insurance Review. 2015.

- Dubai Health Authority. Health insurance mandate for Dubai healthcare providers. Dubai, UAE. 2014.

- Dubai Health Authority. Health Accounts System of Dubai. Dubai, UAE. 2014.

- Dubai Health Authority. Health insurance law of Dubai ? employers? information pack. Dubai, UAE. 2014.

- Dubai Health Authority. DHA imposes fines on 25 facilities that violated the Dubai Mandatory Health Insurance Law. 2017.

- Rudman WJ, Eberhard JS, Pierce W, et al. Healthcare fraud and abuse. Perspect Health Information Manag. 2009;6:1.

- Patel KK, West ML, Hernandez LM. Helping consumers understand and use health insurance in 2014.

- Gionne D. The effects of insurance on the possibilities of fraud. The Geneva Papers on risk and insurance. 1984;32:304-21.

- Head GL, Kwok-Sze RW. Risk management for public entities. Malvern, Pa: Center for Advancement of Risk Management Education. 1999;4-5.

- America?s Health Insurance Plans. Research Brief: Insurers? Efforts to Prevent Health Care Fraud. New York, USA.

- Cressey D. Other people?s money: a study in the social psychology of embezzlement. Glencoe, IL: Free Press. 1953.

- Dean PC, Vazquez-Gozalez J, Fricker L. Causes and challenges of healthcare fraud in the US. Int J Bus Soc Sci. 2013;4:1-4.

- Levinson DR. Medicare Part B billing for Ultrasound. Washington DC: Department of Health & Human Services.

- Hyman D. HIPPA and health care fraud: An empirical perspective. Cato J. 2002;22:151-78.

- Australian Government Department of Health and Ageing. Medicare benefits schedule book, category 2. Canberra, Commonwealth of Australia. 2012.

- Medicare Australia. Compliance case studies, 2009-2010. Canberra: Commonwealth of Australia. 2012.

- SAS. Addressing Dubai?s healthcare claims? fraud, Waste & Abuse through Advanced Analytics. 2015.

- ACL. Fraud detection using data analytics in the insurance industry. Vancouver: ACL Services Ltd. 2014.