Research Paper - Journal of Finance and Marketing (2023) Volume 7, Issue 1

Examining the role of Market Concentration in enhancing Total Factor Productivity: A comparative analysis of selected Agri-based and Hi-Technology Sectors

Puneet Kaur*

Department of Finance and Management, Delhi University, India

- Corresponding Author:

- Puneet Kaur

Department of Finance and Management

Delhi University, India

E-mail: puneetrahat@gmail.com

Received: 02-Dec-2022, Manuscript No. AAJFM-22-82095; Editor assigned: 05-Dec-2022, PreQC No. AAJFM-22-82095(PQ); Reviewed: 19-Dec-2022, QC No. AAJFM-22-82095; Revised: 02-Jan-2023, Manuscript No. AAJFM-22-82095(R); Published: 16-Jan-2023, DOI:10.35841/aajfm-7.1.161

Citation: Kaur P. Examining the role of market concentration in enhancing total factor productivity: A comparative analysis of selected agribased and hi-technology sectors. J Fin Mark. 2023;7(1):161

Abstract

Purpose: This present research is an effort to determine market concentration in selected agri-based and hi-tech sectors and analyse market performance via total factor productivity (TFP) analysis. Earlier literature on a linkage between market structure and market performance has mixed results. Some researchers support that high market concentration results in high productivity, while other researchers provide evidence that the above relation is not true. To examine this in detail, this paper examines the impact of market concentration on TFP, and then makes a comparative analysis of selected Agri-based and Hi-Technology Sectors in India, with the data covering the period 2006-2017. Methods: The study has used Translog index for calculating TFP. TFP gives a complete picture rather than labour or capital productivity. Data for calculating productivity have been taken from Annual survey of Industries and deflated with respective indices to give a realistic picture. For market concentration data were taken from CMIE and four firm concentration ratios were calculated. Finally, regression analysis was applied to determine the relation between TFP and market power. Hi-tech sector has two industries viz. motor vehicles, trailers and semi-trailers#29; and chemicals & chemical products#20. Agri-based Industries relatively considered low in technology were food products#1o and tobacco and tobacco products#12. Findings: Results of 4-firm concentration ratio highlight moderate concentration Hi-tech sectors, viz. in automobile and chemicals & chemical products. Agri based low technology sectors, viz. Food Product industry had lowest concentration ratio, while Tobacco was the most concentrated. Next step was to find total factor productivity for these sectors. The regression analysis showed a significant relationship between TFP and Market Concentration in case High tech sector, viz. Motor Vehicles, Trailers and Semi-Trailers #29 and Chemicals and Chemical Products #20, however, in case of agri-based, low tech sector, viz. Food Products #10 and tobacco and tobacco products#12 the relation between TFP and Market Concentration was low and weak. The results don’t suggest that market concentration alone could be a strong predictor of productivity.

Keywords

Market concentration, 4-firm concentration ratio, Total factor productivity.

Introduction

Manufacturing has an important role to play in the development of any economy. A comparison between pattern of growth across sectors of China and India reveals that its growth from 1978 to 2007 can primarily be attributed to its manufacturing sector, while India’s growth relied mainly on its service sector for growth. Bosworth and Collins [1] reported that during the period 1993-2004, the reallocation of workers from agriculture to industry and services contributed 1.2 percentage points to annual productivity growth in both India and China. China is looked upon as the manufacturing hub of the world, while India has witnessed growth in the software, communication, and finance. As earlier evidence supports that no country has become a major economy without first becoming an industrial power. Thus, the revival of the manufacturing sector is imperative for India to achieve an inclusive and sustainable growth. Nations can compete in the international market only if the firms are competitive. The manufacturing sector spurs demand for raw materials and intermediate goods and allied activities like transport, financial etc. Ahluwalia [2] points out those Indian firms took decades to catch up to global productivity levels.

Structural economists like Kuznets [3] have empirically demonstrated that growth is brought about by changes in sectoral composition of economies overtime. Along with rising levels of income, the demand for agricultural products relatively diminish, while that for industrial goods rise and, after reaching a significantly high level of income the demand for services increases sharply. From the perspective of supply side, Kaldor [4] considered manufacturing as the engine of growth because agriculture being subject to diminishing returns is not able to sustain an increasing level of production and income. The manufacturing sector, being free from such limitations on expansion of production, is thus the key to sustained economic growth. Structural changes not only comprise of the process of economic development, they are also essential for sustaining economic growth. The classic dualism model [5], maintains that economic development is essentially a process of shifting resources from low to high productivity sectors, thereby raising economy-wide productivity.

In order to sustain high growth rate and development, the Indian needs to reinvigorate its manufacturing sector. Indian government launched the make in India Champaign in 2014 to revive the manufacturing sector. The role of this sector is essential to address the problem of rising unemployment. In India 87 percent of manufacturing employment is in microenterprises of less than 10 employees is unparalleled. The closest comparator being Korea, where less than half of employment is in micro-enterprises. There is a fairly high share of very large companies but there are few enterprises of intermediate size. The small scale of Indian industry took place by design due to pre-reform licensing system when only one major company was allowed to operate in many industries, while other industries were reserved for the small-scale industries. While these market entry restrictions are removed but their legacy continues to reduce competition, scale and productivity in many sectors. In addition, other regulations persist, notably those related to labour. Due to small size of so many manufacturing firms, India is reaping far smaller gains from scale economies than many other countries. Larger firms use newer technologies and achieve economies of scale and thus achieve higher productivity, while smaller establishments are much less productive. In view of emerging role of manufacturing, it is important to analyse the performance of manufacturing not through the increase in value added, but through total factor productivity, which gives a realistic and practical picture.

Literature on human capital, supports the role it plays in productivity of individuals [6, 7] and it is also considered an eminent factor in influencing competitiveness and productivity of firms [8, 9]. A study [10] highlights R&D and bonus system as the significant investments in human capital to enhance labor productivity. When examining growth in India [2, 11, 12] have emphasised the focus on total factor productivity. In view of these studies, the current study has used Total factor productivity and not partial productivity to present a holistic approach. The productivity studies on registered manufacturing report mixed results. Ahluwalia [2] reports a turnaround in productivity in 1981. However, Balakrishnan & Puspangagdan [13] reported no turn around, if double deflation method registered manufacturing weights were used. Rao’s study [12] again supported a turnaround. Kaur and Kiran [14] also examined productivity from 1981- 2003 supported that Indian manufacturing reported positive but low productivity growth during the entire period. However, the study [14] reports a deceleration in Post-reform era, i.e. 1991 onwards. In view of these diversified results, it becomes important to examine productivity in selected sectors of Indian Manufacturing. Further the study selected two industries representing hightechnology sector and two industries from agri-based low technology sector to have a better picture of productivity at disaggregate level. Krishna [15] reported that Manufacturing TFP growth was less stable in India as compared to services; while it was reverse scenario in China. Zhou contends that robust institutions expedite the productive employment of workers by providing an efficient and informative labour market that actively responds to changes in labour supply and demand in declining and growing sectors. Productivity growth has stalled across advanced economies [16, 17]. A slowdown in productivity growth is reported in the post-crisis period across advanced economies, emerging market economies and also low-income countries. This further accentuates the need for examining recent trends in TFP productivity in India, an emerging economy.

It becomes important to find out market concentration of these sectors. For market concentration, as suggested by researchers [18] 4-firm concentration ratios were applied to see whether these industries in high-tech and low-tech sectors had high or low concentration ratios. According the study examines concentration ratios in all four industries viz. motor vehicles, trailers and semi-trailers#29; chemicals & chemical products#20; food products#10: and tobacco & tobacco products#12 for the same time period, viz. 2006 to 2017. Researchers have tried to examine the linkage between Market Concentration and TFP. Is market concentration related with productivity? Market concentration, is often taken as a proxy for the intensity of competition. Researchers argue that increase in concentration stifles competition, damages innovation and decelerates productivity. It is time to examine that has concentration increased in registered manufacturing. Many researchers’’ have associated rising concentration with productivity slowdown [19, 20]. This was supported by Rumsey who concluded that since 2000, U.S. aggregate productivity growth has decelerated while product market concentration increased. Even the productivity differences among firms in the same sector widened. Rising concentration, slower productivity growth, and wider technology differences were associated with development in Internet and Information Technology. There are varied reasons for increase in market concentration, like excessive regulations create high barriers to entry and thus, monopolies [21]. Moreover increased mergers and acquisitions could also be associated with increase in concentration [22]. In view of these developments across the globe, it would be important to examine the market power and productivity scenario of selected manufacturing industries. Moreover, it would also be important to examine the linkage between market power and TFP. This study would gain important if we classify sectors as high-tech sectors and low tech agri-based sectors and investigate the linkage between market power and TFP in these sectors. This study in turn examines TFP in selected sectors for the 2006-2017.

Empirical study by Cohen and Levin [23] use production or cost function as a starting point to derive TFP growth as function of industrial concentration. Consistent with the theory and some recent empirical work [24, 25] the initial specification of the productivity-industrial concentration relationship is examined through.

Where tfpit is the annual growth rate of TFP, Crit is the annual growth rate of concentration, and Crsqit is the square of the annual growth rate of concentration, subscripts t and i denote time and industry, respectively, and "it captures all shocks to TFP growth. Keeping these in view, the present study has been undertaken with the following broad objectives:

Objectives of the Study

1. To analyse the market power for the selected agri-based and Hi-Technology Sector.

2. To analyse the trends in Total Factor Productivity the selected agri-based and Hi-Technology Sector.

3. To examine the effect of market structure on productivity the selected agri-based and Hi-Technology Sector.

Review of Literature

Review has been classified into the following:

1. Review on Productivity

2. Review on Market Concentration

Review on productivity

Productivity is defined as volume of output to a volume measure of input use. It is often measured “residually”. This residual explains the difference between efficiency, technical change, capacity utilization, economies of scale, learning by doing and measurement errors. There is rich literature on productivity across the globe analysing and evaluating the impact of liberalization on productivity. The studies have tried to analyse the differences in productivity levels among the developed and developing nations and also analyse the reasons for low productivity levels in developing economies. Restuccia [26] in addressing the reason for underlying low total factor productivity (TFP) in poor countries due to misallocation of across heterogeneous units. Acemoglu and Zilibotti [27] have attributed the differences in productivity across U.S. and poor countries to technology skill mismatch. Earlier studies [13] considered technology as the main source of divergence in TFP. Acemoglu and Zilibotti [27] initially tested the implication of their model for cross country differences in sectoral productivity levels. The startling results point out that the average TFP in LDCs is twenty two percent lower as compared to the U.S level in nine least skill intensive sectors, while it was thirty percent lower in nine most skill intensive sectors. Kpognon [28], analyses the effect of institutional quality on labour productivity in sub-Saharan Africa (SSA). Considering a panel of 31 countries from 1996 to 2016, an empirical model based on the stochastic frontier production function was developed [29]. The researchers’ apply generalized method of moments (System-GMM) and within estimators. The results reflect that institutional quality indicators have a positive and significant influence on labour productivity. Political stability, government effectiveness and the rule of law contribute extensively to enhancing labour productivity.

Krugman [15] investigated the reasons for phenomenal growth by some fast growing Asian economies and to find out whether these extraordinary growth rates could be sustained in the long run. An increase in input which does not translate in higher efficiency with which those inputs are used will lead to diminishing returns, thereby imposing limitation to an input driven growth in the long run. He maintains that their rapid growth is attributable to their ability to mobilize resources than efficiency increase. He further expressed that reforms are likely to increase within firm productivity due to increased efficiency following competition leading to lower average costs. In a study, similar [3, 30] empirically assesses the effect of information and communications technology (ICT) on productivity of ASEAN5 (Malaysia, Indonesia, Philippines, Singapore and Thailand) plus 3 (China, Japan and South Korea). The study suggests a positive influence of ICT on productivity. Based on a Cobb–Douglas production function the framework decomposes the growth rate of GDP into the contributions of the rates of growth of the aggregate physical capital, labour and ICT plus a residual term typically referred to as the growth rate of TFP. The time period of 60s & 70s witnessed the labourdriven policies and onset of export-oriented economies. The second phase covering 1980s, 1990s and 2000s witnessed a diversification of the selected into more advanced industries through investment-driven policies and trade liberalisation to attract foreign direct investment (FDI) through Transnational Corporations (TNCs) investment. The results suggest the manufacturing sector as the engine of growth leading to economic structural transformation.

Comparing the Japanese and Korean models of economic development with other Asian countries, the TFP contribution indicated that both Japan and Korea had developed real productivity with technological progress, while other Asians countries gained developed their economies through inputdriven processes.

Bernard, Redding and Schott [31] concluded that improved competition forces firms to manufacture products they are more competent in and also as according to Leibenstein it reflected improved X-efficiency. Topalova [32] examined the effect of reforms on firm level productivity [33, 34]. They found that a decrease in trade protection leads to higher productivity levels. They attribute this to increase in competition resulting from lower tariffs on output and inputs. Jibir [10] examines the relationship between human capital and labor productivity and included firm size, age, and location too. Inter industry productivity levels show that refined petroleum product industry had the highest average labor productivity, followed leather industry. Education influenced labor productivity. Stocks of and investments in human capital contribute considerably to labor productivity. R&D and bonus system emerged as critical investments in human capital for boosting labor productivity.

A number Indian studies have tried to evaluate the impact of liberalization policy on productivity, because the crux of the policy reforms was primarily to improve industrial productivity and eliminate inefficiency owing to concentration. Among the first generation of important work do ne in this context is by Ahluwalia [2]. The study at a disaggregate level in the seventies revealed p oor performance of TFP growth till the end of seventies. However, a turnaround was reported in the first half of eighties, and TFP grew at reflecting a marginal decline of 0.3 percent per annum. This improvement 3.4 percent per annum in the first half of eighties, compared to virtual no growth in the previous decade in the TFP in the first half of eighties was due to improvement in labor productivity, measured as output per worker. Capital productivity however remained stagnant. Critics point out a bias in productivity estimation due to single deflation method used for value added. Thus, Balakrishnan and Pushangadan [11] challenged Ahluwalia’s claims that TFP accelerated after 1980 due to liberalization. Using double-deflation (DD) measure for estimation the results were contrary those reported [2]. Even Rao [12] which resulted in an estimation of value added production function based on double deflation procedure and gross output production function supported claims [11]. They reported no turn around in the eighties. Finally, a third generation of studies focused on the impact of trade policy reforms on productivity growth post 1991. Most of them have used gross output function to calculate TFP. They have used capital, labour, material, energy and also services to calculate TFP. Nearly all these studies reveal no improvement in productivity trend in the post-reform period.

Trivedi reported that TFP growth in manufacturing grew at 1.88 percent per annum in the period 1980-1991; compared to 1.05 percent per annum from 1992-2007. Srivastava [35] examined the effect of liberalization using data from a sample of public limited companies covering the period of 1980- 81 to 1989-90. Another study [15] used panel data from CMIE Database to examine the impact of liberalization on Indian firms. They allowed returns to scale to change after liberalization from 1986 to 1993. They report an increase in competition and find reduced returns to scale on randomly chosen industries like electronics, electrical machinery, nonelectrical machinery and transport equipment. The researchers reported a diminished evidence of increased productivity following reforms.

Productivity was estimated based on Solow model in both pre and post liberalization period. In another significant work [14] an attempt has been made to estimate productivity changes pre-liberalisation (1980-81 to 1990-91) and post liberalization 1991-92 to 2002-2003 periods. They took a detailed analysis of input both labour and capital and output besides calculating both partial and TFP for the entire period. TFP grew at a rate of 1.24 percent for 1980-81 to 2002-03. Further a high TFP growth was reported in pre liberalization period over a lower TFP in post-reform. A deceleration in capital was also reported in the latter period. Thus, it can be inferred that productivity related studies report mixed results. Hence it was thought essential to calculate productivity for the period 2006-2017. This productivity growth would then be used for relating it with Market Concentration. The next section discusses the studies related with market concentration and also studies focusing on link between Market Concentration and Productivity.

Review on market concentration

Among other factors which affect productivity, the researchers’ would try to examine the effect of competition on productivity as diverse concentration levels give rise to different productivity and efficiency levels depending on the level of competition in the market. The models of firm profitability are divided into two broad categories. First structure-conduct-performance model based on neo-classical theory and second firm effect model which link profitability to concentration. The structure of market is essentially classified by the presence of or the absence of competition. When the competition is less, market is said to be concentrated and vice versa. Concentration levels within industries give rise to difference in productivity levels through divergent efficiency levels. Higher concentration levels can make more efficient firms exploit economies of scale. Under the classical structureconduct- performance model performance and conduct of firms influence structure [18].

Market structure refers to the number of firms and also their market share along with other features which affect competition. Besides this, the degree of concentration in an industry affects the behaviour and profitability of firms. Stierwald [36] opined that higher concentration levels lead firms to collude and enable them to reap more profits. Firm effect models on the other hand, assume that firms are heterogeneous within industry. Firms can further be distinguished on the basis of their efficiency levels.

Theoretical literature on market competition however does not clearly establish that increased competition both domestic and international will result in consequent higher productivity. Lacking a clear cut, uniquely established definition of competition, there are several ways to define market competition. It is shown by a change in the mode of competition from monopoly to perfect competition [37]. Further, it can be reflected by a change in structure of market pivoting from Cartel top Cournot and then from Cournot to Bertrand as captured by increase in the number of firms. It is also reflected through an increase in the number of firms [15, 38, 39]. Increased price elasticity of demand resulting in cost reduction and leading to productivity gains is emphasized by Willig and competition may even be reflected as decrease in profits [40]. However, increase in Market concentration may reflect increase in market power. Nickell [24] based on data of UK firms demonstrated that product market competition enhances productivity growth. He measured competition by the increase in the number of competitors. He provides evidence of increased competition having significant positive effect on corporate performance.

After enumerating ways in which competition can be defined, an attempt has been made to examine how the extent of competition can be measured. Thus, there is an issue of measurement of concentration. Fragmented markets with larger number of firms would essentially result in greater internal competition and higher productivity levels. Firms operating in more concentrated market structures might be under less competitive pressure and thus might make less effort, which may be reflected in lowering their productivity levels. Market concentration implies a situation where a small number of leading producers are largely engaged in that industry. It is measured by two variables of relevance (a) Number of firms in the industry (b) their relative size distribution.

As Concentration levels or market structure have far reaching consequences on market performance such as productivity, technical progress, profitability etc. It is important to review literature covering the association between Market Concentration and Productivity Growth. Literature suggests that there are few studies that have focussed exclusively on finding out the effect of market structure on the productivity across industries in Indian context.

Theoretical Underpinnings

Kato [7] indicated that the smaller the market share of a firm, the higher was the productivity growth and this effect was found to be more conspicuous in less concentrated market. In a later study, Autor concluded that industries where concentration levels rose the most displayed faster rise in productivity levels. These patterns were not only observed in U.S. firms but also internationally. They used concentration of sales within an industry either as the fraction of total sales accruing to 4 largest denoted as CR4 or largest as CR20. It is imperative to examine whether Indian firms also depict a similar trend?

Gisser [41] in an industry specific study examined the link between concentration and productivity in Food Manufacturing industry in the U.S found the relationship to be monotonic. Four firm concentration ratios, was calculated to be 36 percent. It was concluded that an attempt to restructure the food industry may deprive society of benefits of concentration in terms of scale economies. Earlier literature [42], conclude that concentration improves production in less developed countries, but may impede production developed countries. According to this study concentration promotes innovation which in turn increases productivity. At the national level rather than regional level they suggest industrial structure can affect productivity either positively or negatively depending on the level of concentration. This framework fits well for food industry where number of firms is large and is heterogeneous in productivity supplying differentiated products. Their concentration ratio ranged between low 22 percent to a high of 90 percent. The study reported an inverted U-relationship between concentration and cost reduction and results suggest that after a critical level, the relation of industrial concentration with productivity growth becomes negative.

The productivity–industrial concentration relationship is subject to specification problems, as all growth in productivity may not be contributed by concentration. Cohen and Levin [23] regard demand structure, technological opportunity and appropriability as additional factors influencing the rate of innovation in industry. Baldwin and Martin [43] opines that higher concentration of industry promotes economic growth. Minniti and Parello [44] adapt a semi-endogenous growth framework to investigate the relationship between trade integration and scale invariant economic growth. Earlier literature suggests variant results as Braunerhjelm and Borgman [45] support a positive association between industry concentration and labor productivity growth in Sweden. Brülhart and Sbergami [46] in cross-country analysis highlight that relation between the two is dependent on a country’s level of economic development. Gardiner [47] confirms an inverse relation between industry concentration and GDP growth for several levels of agglomeration in European economies.

These mixed results are the reason to conduct a study in Indian context. Thus, though this topic has been researched, but there are not much solid evidences which can be generalized. Moreover link between competition and productivity vary from one study to another. Thus, there is scope of research in this area. Keeping in view the above perspectives, the present research has been taken to find out whether Market Concentration enhances Total Factor Productivity taking selected agri-based and Hi-Technology Sector.

Research Methodology

Data Sources: The primary source of 2-digit ‘Manufacturing Industry Database 2006-17. The source of data to measure productivity is the Annual Survey of Industries (ASI) which is published by Central Statistical Organization (CSO), Government of India. Most of the earlier studies on productivity [2, 12] have also used this as their principal data base. However, to measure the industry wise concentration ration the sales of the top four firms in the industry is required so for that purpose data is obtained from data from publications of CMIE (Centre for Monitoring Indian Economy) prowess data base. The Prowess database includes all companies traded on the National Stock Exchange and the Bombay Stock Exchange, and includes thousands of unlisted public limited companies and hundreds of private limited companies [42].

Time Period Covered in the Study

The time period for the study chosen is from 2006 to 2017. Productivity analysis has been done at the aggregate level for the selected industries in the manufacturing sector. Further to study the effect of market structure on productivity industry specific concentration ratio (CR4) has been calculated by taking the sales of top 4 firms in each industrial group for the selected time period. Lastly an inter industry comparison is made after linking cr4 with the productivity in each group.

Translog Index

In this study the measure of Total Factor Productivity (TFPG) used is derived from a Translog production function under the assumptions of competitive equilibrium. TFP is a discrete approximation to the Divisia index of technical change. It has the advantage that it does not make rigid assumptions about elasticity of substitution between factors of production (as for instance by the Solow Index) Translog index of total factor productivity is based on transcendental logarithmic production function characterized by constant return to scale.

Total output divided by number of workers or hours worked it is termed as labour productivity. Where V, L, K, TFP and SL denote value added, labor, capital, total factor productivity and share of labor income in value added respectively.

To study the effect of market structure on productivity Cr4 or concentration ratio is calculated.. For this the Total sales of the four largest firms are added and then divided by the total sales of the industry which is converted to percentage.

Variables of the Study

Measurement of Output: The study has used gross value added (GVA). GVA is deflated by industry specific Indices.

Capital Input

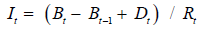

Despite the importance in economic theory capital is the most difficult concept to measure empirically. There are conceptual problems involved in its measurement. The problem of defining and measuring capital is hardly settled as yet. Considerable differences are seen with regards to measurement of capital input. The differences are observed with regard to the measurement of capital input. The difference in total factor productivity estimates between studies may be attributed largely to the difference in capital estimates. Perpetual inventory method has been used in the present study for estimating capital. This method has been used in a number of countries for estimating the capital series. In the Indian context this method has been used in various studies [48, 11, 12]. Investment is the net addition to capital stock within the country in the form of plant and machinery, building and other capital goods. The investment figures are obtained using the formula:

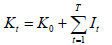

Where B is the book value of fixed capital, D is the depreciation and R is an appropriate deflator for fixed capital. For R, wholesale price index of machinery (base 2004-05=100) has been used. Capital stock for any year may be calculated as follows:

Where I is investment in year t and K0 is capital in bench mark year i.e., 1980-81.

The figures on fixed capital available in ASI are the book values of fixed assets. The use of un-deflated book value is inaccurate. The book values are therefore deflated by a price index. The weakness of using deflated data is that it does not take into account assets of different vintages brought at different points of time. Therefore perpetual inventory method has been used. Once estimation of capital stock for 1980-81 is done the rest of series of the fixed capital is worked out by first estimating real investment in fixed assets in subsequent years and then adding such investment to the benchmark estimates. The researchers had created a series of capital [14]. Assuming constant returns to scale the share of capital is obtained as one minus share of labour.

Labour Input

Labour is the single most important input to many production processes. Many arguments are put forward while specifying a measure of labour input. Total persons engaged as a measure of labour input include both workers and persons other than workers. It is argued that such workers are as much important for getting the work done as the workers who operate the machines therefore their services should be taken into account in measuring labour. The share of total emoluments in value added is taken as the share of labour.

Concentration Ratio CR4

The concentration ratio for market structure is estimated to measure concentration levels using CR4 ratio so that more weight age is given to top 4 firms in addition to its advantage of ease of calculation and estimation and hence greater accuracy. Concentration levels or market structure might have far reaching consequences on market performance such as productivity, technical progress, profitability etc. CR4 concentration ratio is defined as the market share of four largest firms. This ratio shows if the industry comprises of a few large firms or many small firms. This ratio varies between zero to hundred percent. It is also an indicator of degree of competition in a particular industry. Lower the ratio indicates greater the competition in an industry. Ratio close to hundred means monopoly.

Data variables and Sources are represented through table 1.

| Variable | Definition | Source |

|---|---|---|

| GVA | Gross Value Added | Annual Survey of Industries (ASI) |

| CR4 | Concentration Ratio | CMIE Data and calculation |

| *Capital | PIAM | Computed |

| Investment | Investment is the net addition to capital stock within the country in the form of plant and machinery, building and other capital goods. | Annual Survey of Industries (ASI) |

| Labour | The present study uses total persons engaged from Annual Survey of Industries for the chosen time period. Total persons engaged as a measure of labour input include both workers and persons other than workers. | Annual Survey of Industries (ASI) |

| Total Emoluments | The share of total emoluments in value added is taken as the share of labour. | Annual Survey of Industries (ASI) |

| SL respectively | The share of total emoluments in value added is taken as the share of labour. | Annual Survey of Industries (ASI) |

| SK | Share of Capital (1-SL) | Annual Survey of Industries (ASI) |

| TFP | Total Factor Productivity | Calculation from ASI data |

| Deflation- Capital | The data on capital has been deflated using wholesale price index of machinery (Base 2004-2005=100) | Wholesale price index of machinery (WPI) |

| Deflation-Gross value added | The data on gross value added has been deflated using industry specific wholesale prices (Base 2004-2005=100). | Industry specific wholesale prices. |

| Deflation-Total Emoluments | The data on total Emoluments has been deflated using industry specific wholesale prices. (Base 2004-2005=100). | Industry specific wholesale prices. |

Table 1. Data Variables and Sources

Data Analysis

In section 5.1 results of Market concentration is depicted through CR4 of selected industries. Productivity trends are highlighted in section 5.2. Section 5.3 highlights the Industrywise trends in TFP and 5.4 Impact of Market Concentration (CR4) on Performance (Total factor Productivity).

Market Concentration

Section 5.1 presents the Market structure measured for the selected group of industries. The concentration ratio, which is a common measure of market structure, shows the combined market share of the largest firms in the market. CR4 has been used in the present study. The results of concentration ratios (CR) range between 0 to 100 percent. While 0 to 40 percent implies low concentration, 40 to 70 percent implies medium concentration or an oligopolistic market structure, where small number of firms dominates the market. CR in the range of 70 to 100 percent is an indicator of high concentration ranging from oligopoly to monopoly. Indian market structure is u-shaped overall which is dominated by small number of large firms on one end indicating oligopoly and large number of small firms on the other end indicating competitive market. Data for CR4 has been collected with the help of CMIE prowess data for the relevant industries to get the top players for each industry for all years (2006-2017). Total sales of the four largest firms are added and then divided by the total sales of the industry which is converted to percentage. The results are depicted through table 2.

| Years | Tobacco Products#12 | Food Products#10 | Chemicals & ChemicalProducts #20 | Motor Vehicles, Trailers and Semi-Trailers #29 |

|---|---|---|---|---|

| 2006-2007 | 93.89 | 27.03 | 63.93 | 60.77 |

| 2007-2008 | 94.53 | 25.85 | 60.77 | 57.6 |

| 2008-2009 | 94.1 | 25.58 | 62.94 | 62.94 |

| 2009-2010 | 94.51 | 31.93 | 61 | 61 |

| 2010-2011 | 93.98 | 34.31 | 60.44 | 60.44 |

| 2011-2012 | 92.73 | 31.31 | 57.75 | 57.75 |

| 2012-2013 | 91.85 | 35.7 | 55.44 | 55.44 |

| 2013-2014 | 91.32 | 34.45 | 46.64 | 46.64 |

| 2014-2015 | 90.62 | 30.38 | 44.82 | 44.82 |

| 2015-2016 | 91.68 | 30.26 | 44.15 | 44.15 |

| 2016-2017 | 95.95 | 34.2 | 47.29 | 47.29 |

Table 2. Industry-wise CR4 Ratios

Motor Vehicles, Trailers and Semi-Trailers #29 depicted moderate CR in the range of 50 to 60 percent. However, a slight decrease is observed from 2013 to 2017, suggesting that over the years CR has decreased. Chemicals & Chemical Products #20 is also in the range of moderate concentration with CR between 45 to 63 percent. In this industry, a decline in CR is observed from 2012 to 2017. Thus, two industries covered in high-tech sector depict moderate CR. In agri-based Sector, Food Products #10 has low concentration, with levels ranging from 25 to 35 percent, while Tobacco products #12 depicted the highest concentration levels in the range of 90 to 96 percent. It can be inferred that all four industries possess different Concentration ratios. Having calculated CRs, it was important to understand the performance of these selected industries in two sectors.

Industry-wise trends in value added

To understand which industry is growing at a faster rate Industry wise trend rates of growth in value added were also calculated. The results are depicted through table 3. The trend based growth of log (GVA) for the period reveals that Motor Vehicles, Trailers and Semi-Trailers #29 industry was the fastest growing one with a growth rate of 6.64 percent. Tobacco sector#12 recorded a fairly high growth rate at 4.95 percent. However, Food products sector #10 recorded a moderately high growth rate at 4.48 percent. Tobacco Products#12 also depicted a moderate growth of 4.95 per cent per annum. Chemicals and Chemical Product#20 sector recorded a relatively lower growth rate of 3.54 percent. It was the slowest growing industry in the group. The results bear a testimony that all selected industries in the two sectors were growing industries, as positive growth rates were observed, if only value-added growth measures were used. The real growth could be estimated through growth in TFP.

| Industry wise Trend based Growth Rates for value added | |||||||

|---|---|---|---|---|---|---|---|

| Group | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Growth rate | ||

| B | Std. Error | Beta | |||||

| Chemicals & Chemical Products#20 | Case Sequence | 0.035 | 0.006 | 0.897 | 6.077 | 0.000*** | 3.54 |

| (Constant) | 6.725 | 0.039 | 173.048 | 0.000*** | |||

| Food Products#10 | Case Sequence | 0.044 | 0.004 | 0.966 | 11.244 | 0.000*** | 4.48 |

| (Constant) | 6.509 | 0.026 | 246.1 | 0.000*** | |||

| Motor Vehicles, Trailers and Semi-Trailers #29 | Case Sequence | 0.064 | 0.005 | 0.976 | 13.34 | 0.000*** | 6.64 |

| (Constant) | 6.349 | 0.033 | 194.093 | 0.000*** | |||

| Tobacco Products#12 | Case Sequence | 0.048 | 0.004 | 0.964 | 10.872 | 0.000*** | 4.95 |

| (Constant) | 5.741 | 0.03 | 190.367 | 0.000*** | |||

Table 3. Industry wise trend based Growth Rates for Value Added

Industry-wise trends in TFP

After exploring the trends in market structure and value added for the selected industries, it becomes imperative to compute total factor productivity (TFP) for the same selected group of industries. TFP has been calculated at for the selected four industries from the year 2006-2017. TFP was calculated using Translog production function. TFP was low for all the selected industries. The results are shown through table 4.

| Years | Tobacco Products #12 | Food Products#10 | Chemicals & Chemical Products#20 | Motor Vehicles, Trailers and Semi-Trailers #29 |

|---|---|---|---|---|

| 2007-2008 | -0.002 | 0.01 | 0.051 | 0.012 |

| 2008-2009 | 0.165 | -0.039 | -0.118 | -0.044 |

| 2009-2010 | -0.086 | 0.059 | 0.062 | 0.179 |

| 2010-2011 | 0.108 | 0.102 | 0.047 | 0.048 |

| 2011-2012 | 0.017 | 0.086 | 0.145 | 0.106 |

| 2012-2013 | 0.097 | -0.012 | -0.055 | 0.05 |

| 2013-2014 | -0.008 | 0.031 | 0.015 | -0.051 |

| 2014-2015 | 0.008 | 0.024 | 0.005 | 0.133 |

| 2015-2016 | 0.098 | 0.051 | 0.139 | 0.077 |

| 2016-2017 | 0.275 | 0.549 | 1.176 | 0.553 |

Table 4. Industry wise total factor productivity.

Productivity remained sluggish for most of the years for Chemicals and Chemical Products #20. It was it was marginally negative for 2008-2009 and for 2012-2013. Even Motor Vehicles, Trailers and Semi-Trailers #29, depicted sluggish growth for most of the years. For Food Products #10: also the productivity remained low and it was marginally negative for 2008-2009 and 2012-2013. TFP for Tobacco Products #12 remained low and it was negative for 2007-2008, 2009-2010 and 2013-2014. Thus, it can be inferred that TFP for most of the selected industries were low. Thus, both sectors high-tech and agri-based sector depicted low productivity. Next step was to relate Market structure (CR4) with Performance (Total factor Productivity).

Impact of Market Concentration (CR4) on Performance (Total factor Productivity)

Food Products #10 industry is the key link between agriculture and the industrial sector and is largely dominated by unorganized units. Some Indian players are making use of newer technologies to increase production and meet international quality standards still the industry largely remains unorganised. Investment requirement, lack of bank credit has been impeding new technology adoption. Shortage of skilled manpower is a challenge as it is labour intensive. Other problems are lack of product innovation, rising food prices etc. Results indicate that this sector is characterised by smaller sized firms and low productivity growth. Performed poorly in post-reform period as well.

Tobacco Products #12: is a significant cash crop of India. India is the third largest producer and second largest exporter of raw tobacco in the world. ITC is the biggest player in this sector which alone accounts for 70 percent of market share. Main reason for ITC’s leadership is its backward integration i.e. it produces its key raw material. CR4 ratio is highest for this industry, but TFP is low. This industry has inelastic demand for its product [51].

India is looking to become one of the world’s largest automobile markets. Due to the entry of foreign players, the competition is increasing and the concentration ratio is declining. The CR4 ratio for Motor Vehicles, Trailers and Semi-Trailers #29 was around 60 percent in the beginning of the study period and was around 50 percent towards the end of the study period. In terms of productivity this industry too has shown a slow growth.

Chemicals & Chemical Products #20 is a marginal player in the international market accounting with 1.9 percent of the global chemical market. Basic Chemicals comprise the largest segment of this industry at 57 percent. The sub-sections of the Indian chemicals are fragmented with high competition e.g. the top ten players in the Indian pesticide segment account for 53 percent of the total market which rest of the players don’t account for more than 10 percent share resulting in low economies of scale. Productivity growth has improved in the last two years. Finally, to analyse the impact of market structure on productivity for the selected industries regression analysis was conducted and the results are shown through table 5.

| B | Std Error | Beta | t-Statistics | F | Adjusted R-square | |

|---|---|---|---|---|---|---|

| Motor Vehicles, Trailers and Semi-Trailers #29 | -0.95 | 0.215 | -0.843 | -4.425 (0.002**) |

19.57 (.002**) |

0.674 |

| Chemicals and Chemical Products #20 | -0.515 | 0.16 | -0.751 | -3.22 (0.001***) |

10.37 (0.001***) |

0.51 |

| Food Products #10 | 0.468 | 0.294 | 0.491 | 1.595 (0.149) |

2.544 (0.149) |

0.146 |

| Tobacco Products #12 | 3.298 | 4.296 | 0.262 | 0.768 (0.48) |

0.538 (0.43) |

0.048 |

Table 5. Impact of market structure (CR4) on Performance (TFP).

The regression analysis showed a significant relationship in case of two sectors, viz. Motor Vehicles, Trailers and Semi- Trailers #29 and Chemicals and Chemical Products #20. The regression analysis was significant at p-value≤.01level for Chemicals and Chemical Products #20and at p-value≤.01for Motor Vehicles, Trailers and Semi-Trailers #29. The results however depict that there is inverse relation of Market concentration and Productivity for both industries in high tech sector, viz. Motor Vehicles, Trailers and Semi-Trailers #29 and Chemicals and Chemical Products #20. Both these industries had moderate concentration ratios. B-values were positive for Food Products #10 and for Tobacco Products #12. Both these sectors were unique as Tobacco Products #12 depicted highest CR and Food Products #10 depicted lowest CR [52].

Checking Endogeneity

The sources of endogeneity are mainly of three kinds: measurement error, dual or inverse causality and the existence of omitted variables. In the first case, as Acemoglu [27] point out, institutional variables are derived from expert opinions and survey data and are therefore potentially subject to systematic measurement errors. In our model the research studies [46, 42, 49] suggest that there is a relation between Market Concentration and productivity.

The second is the reverse causality: indeed, high-income countries with higher levels of productivity seem to have better institutions [50]. To rule out inverse causality we checked correlation of Independent variable with Residual variable. The same are represented in table 6. The results highlight that there is insignificant correlation between Market Concentration and Residual variables in all selected industries, viz. Tobacco Products #12; Food Products #10; Motor Vehicles, Trailers and Semi-Trailers #29 and Chemicals and Chemical Products #20 had insignificant correlation ruling out inverse causality.

| Industry | Correlation Coefficient (r) |

|---|---|

| Motor Vehicles, Trailers and Semi-Trailers #29 | 2.40274946947169E-16 |

| Chemicals and Chemical Products #20 | 2.4E-16 |

| Food Products #10 | 6.43826E-16 |

| Tobacco Products #12 | 9.17127182620826E-16 |

Table 6. Correlation: Market Concentration and Residual.

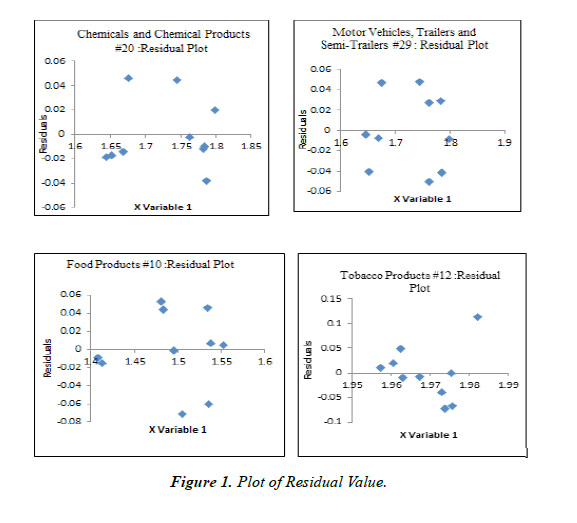

Next we worked on examining the residual variables, where the researchers suggest that values should be insignificant and low. As shown through graphs, Figure I to IV, the values of residuals is very low and hence the model may be accepted. This also checks the existence of omitted variables. Insignificant correlation suggests that we can proceed ahead with the analysis.

The next step was to plot residual values Figure 1.

We also applied instrumental variables 2 SLS regression to check for endogeneity. The results as shown through table 7. Checking for bias and endogeneity Instrumental Variables 2SLS Regression was performed.

| Source | SS | df | MS | No. of observations | 40 | |

|---|---|---|---|---|---|---|

| Model | 0.003206448 | 1 | 0.003206448 | F(1,38) Prob.>F Adj R-Squared Root MSE |

0.07 0.7932 0.0221 0.21463 |

|

| Residual | 1.93481792 | 42 | 0.046067093 | |||

| Total | 1.93802437 | 43 | 0.0045070334 | |||

| TFP | Coef. | Std. Err. | t | P> [t] | 95% conf. Interval | |

| CR4 | -.0483028 | 0.1830861 | -0.26 | 0.793 | -.4177854 | 0.3211799 |

| _cons. | .1771063 | 0.3186876 | 0.56 | 0.581 | -.4660314 | 0.8202439 |

| No endogenous variables | ||||||

Table 7. Instrumental Variables 2SLS Regression.

As reported through results applying Instrumental Variables (2SLS) Regression, the results signify that Co-efficient of CR4 was not significant. Moreover the results through STATA software suggest that there is no endogeneity. We obtained the 2SLS-estimator in 1 step using STATA. OLS estimate is likely consistent and there are no omitted variables or measurement error. Thus, the results of OLS are consistent.

Limitations and Future Scope

In future, the study can be extended to cover more industries. Although there were difficulties in calculating concentration ratios and that was one reason why few industries were chosen for the study. Calculation of TFP needs capital series to be created and there are limitations of methodology in calculation of TFP. TFP has some conceptual deficiencies as differences in assumptions can lead to very different estimates. TFP growth is usually assumed to reflect the technical progress, but interpretation of measured TFP growth can be problematic. This study can be taken as base and it can further be extended to include control variables. The study can be extended in terms of time period for the same group of industries too. Future studies may focus on evaluating the net welfare loss/ gain from increasing concentration and could be useful for antitrust/regulation policies.

Conclusion

Inter-industry productivity highlights that though value added showed an increase during the period, however in terms of total factor productivity the picture is not that glossy. TFP for all the industries were low. In terms of market concentration, CR ranged between low to very high for agri-based sector, while it was moderate for high-tech sector covering Chemical and Motor vehicles. Regression analysis partially establishes the claim that market concentration has an impact on productivity. ANOVA results were significant for two out of four industries, namely Motor Vehicles, Trailers and Semi-Trailers #29 and Chemicals and Chemical Products #20. For both these industries were moderately concentrated, adjusted R-square values were high. In case of Motor Vehicles, Trailers and Semi-Trailers market concentration explained 67.4 percent of variation and for Chemicals and Chemical Products the explanatory power was 51 percent. Food products industry had very low concentration and the value of adjusted R-square was 0.146. In case of tobacco industry, which had highest concentration the explanatory power of market concentration with TFP was very low. Thus, the study failed to establish a strong link in case of Food Products #10 and for Tobacco Products #12. It must be noted that for Food Products #10, CR was lowest, i.e. 25 to 35 percent, while it was the highest for Tobacco industry ranging between 90 to 96 percent. Since, Food Products #10 sector has comparatively low concentration ratio, an increase in concentration may improve productivity through benefits of economies of scale and innovation. On the other hand, Tobacco industry which has high concentration level may be past the critical level of the concentration ratio beyond which the relation between the two has already turned negative. Hence, increased competition from new entrants may help in enhancing the productivity for this particular industry. The TFP results of study are consistent with that of Gordon. The latter researchers reported that policies facilitating innovative start-ups are an important tool to enhance knowledge diffusion and stimulate productivity growth.

The study manages to establish that there is a positive link between market concentration and productivity in moderately high oligopolistic markets. It can also be inferred that link between concentration and productivity in moderately high oligopolistic and Hi-Technology Sector could be established. However, the same is not true for agri-based sector. These results are in line with a study which establishes an inverted-U relationship between concentration and productivity, implying that initially when concentration increases, productivity also increases up to a critical point beyond which a further increase in concentration leads to a loss in productivity rather than a gain. What is this critical level of concentration beyond which it turns negative, needs to be investigated in more detail? It also needs to be investigated why the relationship between the two turns negative beyond the critical level. Could it be that in very highly concentrated markets, the lack of pressure on firms to compete makes the dominant few firms too complacent to innovate or at very high scale of production economies of scale do not function leading to diseconomies of scale. This needs to be investigated in greater detail.

References

- Braunerhjelm P, Borgman B. Geographical concentration, entrepreneurship and regional growth: Evidence from regional data in Sweden, 1975-99. Reg Stud. 2004;38(8):929-47.

- Ahluwalia IJ. Structural adjustment and productivity growth. Coal And Steel Industries. 1997;3:62.

- Kuznets S. Economic growth of nations. InEconomic Growth of Nations. 2013.

- Kaldor N. Causes of the slow rate of economic growth of the United Kingdom: an inaugural lecture. London: Cambridge UP. 1966.

- Mani S. Changing structure of India's manufacturing sector. Unpublished Paper, Center for Development Studies, Trivandrum. 1993.

- Becker GS. Investment in human capital: A theoretical analysis. J Polit Econ. 1962;70:9-49.

- Srivastava V. Liberalization, productivity, and competition: A panel study of Indian manufacturing. Oxford University Press, USA; 1996.

- Abdu M, Jibir A. Determinants of firms innovation in Nigeria. J Soc Sci. 2018;39(3):448-56.

- Gardiner B, Martin R, Tyler P. Does spatial agglomeration increase national growth? Some evidence from Europe. J Econ Geogr. 2011;11(6):979-1006.

- Kaldor N. Causes of the slow rate of economic growth of the United Kingdom: an inaugural lecture. London: Cambridge UP. 1966.

- Rao JM. Manufacturing productivity growth: Method and measurement. Economic and Political weekly. 1996:2927-36.

- Restuccia D, Rogerson R. Misallocation and productivity. Rev Econ Dyn. 2013;16(1):1-0.

- Balakrishnan P, Pushpangadan K. Total factor-productivity growth in manufacturing industry: A fresh look. Economic and political weekly. 1994:2028-35.

- Kpognon KD, Atangana Ondoa H, Bah M, et al. Fostering labour productivity growth for productive and decent job creation in Sub-Saharan African countries: the role of institutional quality. J Know Econ. 2022;13(3):1962-92.

- Krugman P. The Myth of Asia‘s Miracle “Foreign Affairs. 1994:62-78.

- Cette G, Fernald J, Mojon B. The pre-Great Recession slowdown in productivity. Eur Econ Rev. 2016;88:3-20.

- Cohen WM, Levin RC. Empirical studies of innovation and market structure. Handbook of industrial organization. 1989;2:1059-107.

- Bain JS. Barriers to new competition. InBarriers to new competition. Harvard University Press. 2013.

- Hsieh CT, Klenow PJ. The life cycle of plants in India and Mexico. Q J Econ. 2014;129(3):1035-84.

- Topalova P, Khandelwal A. Trade liberalization and firm productivity: The case of India. Rev Econ Stat. 2011;93(3):995-1009.

- Gabdullin N, Kirshin I. Forecasting of the human capital accumulation impact on the labour productivity dynamics in the russian federation. Econ Soc Dev: Book of Proceedings. 2020:285-93.

- Covarrubias M, Gutiérrez G, Philippon T. From Good to Bad Concentration? US Industries over the past 30 years. NBER Macroecon Annu. 2020;34(1):1-46.

- Covarrubias M, Gutiérrez G, Philippon T. From Good to Bad Concentration? US Industries over the past 30 years. NBER Macroecon Annu. 2019;34(1):1-46.

- Prescott E. Needed: A Theory of Total Factor Productivity Federal Reserve Bank of Minneapolis. Research Department Staff Report. 242; 1997.

- Grullon G, Larkin Y, Michaely R. Are US industries becoming more concentrated?. Rev Financ. 2019 Jul 1;23(4):697-743.

- Romer P. Idea gaps and object gaps in economic development. J Monet Econ. 1993;32(3):543-73.

- Acemoglu D, Zilibotti F. Productivity differences. Q J Econ. 2001;116(2):563-606.

- Krishna P, Mitra D. Trade liberalization, market discipline and productivity growth: new evidence from India. J Dev Econ. 1998;56(2):447-62.

- Dorn D, Katz LF, Patterson C, et al. Concentrating on the Fall of the Labor Share. Am Econ Rev. 2017;107(5):180-85.

- Ahmed EM. Information and communications technology effects on East Asian productivity. J Kno Eco. 2010;1(3):191-201.

- Bernard AB, Jensen JB, Schott PK. Trade costs, firms and productivity. J Monet Econ. 2006;53(5):917-37.

- Willig RD. Corporate governance and market structure. InEconomic policy in theory and practice. Palgrave Macmillan, London. 1987. 481-503.

- Gisser M. Welfare implications of oligopoly in US food manufacturing. Am J Agric Econ. 1982 Nov;64(4):616-24.

- Lewis WA. Economic development with unlimited supplies of labour.1954.

- Stierwald A. Determinants of firm profitability-the effect of productivity and its persistence. Melbourne Institute of Applied Economic and Social Research. 2009;25.

- Syverson C. Challenges to mismeasurement explanations for the US productivity slowdown. J Econ Perspect. 2017;31(2):165-86.

- Arrow K. Economic welfare and the allocation of resources for invention. InThe rate and direction of inventive activity: Economic and social factors.1962:609-626.

- Ali J, Singh SP, Ekanem EP. Efficiency and productivity changes in the Indian food processing industry: Determinants and policy implications. Int Food Agribus Manag Rev. 2009;12(1030-2016-82751):43-66.

- Jibir A, Abdu M, Buba A. Does Human Capital Influence Labor Productivity? Evidence from Nigerian Manufacturing and Service Firms. J Know Eco. 2022:1-26.

- Schultz TW. Investment in human capital. Am Econ Rev. 1961;51(1):1-7.

- Gopinath M, Pick D, Li Y. An empirical analysis of productivity growth and industrial concentration in US manufacturing. Appl Econ. 2004;36(1):1-7.

- Gort M, Sung N. Competition and productivity growth: The case of the US telephone industry. Econ Inq. 1999;37(4):678-91.

- Baldwin RE, Martin P. Agglomeration and regional growth. InHandbook of regional and urban economics. 2004;4:2671-2711.

- Nickell SJ. Competition and corporate performance. J Polit Econ. 1996;104(4):724-46.

- Brülhart M, Sbergami F. Agglomeration and growth: Cross-country evidence. J Urb Eco. 2009;65(1):48-63.

- Byrne DM, Fernald JG, Reinsdorf MB. Does the United States have a productivity slowdown or a measurement problem?. Brookings Papers on Economic Activity. 2016;2016(1):109-82.

- El Ghak T, Gdairia A, Abassi B. High-tech entrepreneurship and total factor productivity: The case of innovation-driven economies. J Kno Eco. 2021;12(3):1152-86.

- Ahluwalia IJ. Industrial growth in India: performance and prospects. J Dev Econ. 1986;23(1):1-8.

- Minniti A, Parello CP. Trade integration and regional disparity in a model of scale-invariant growth. Reg Sci Urban Econ. 2011;41(1):20-31.

- Schmitz Jr JA. What determines productivity? Lessons from the dramatic recovery of the US and Canadian iron ore industries following their early 1980s crisis. J Polit Econ. 2005;113(3):582-625.

- Schultz TW. Investment in human capital. Am Econ Rev. 1961;51(1):1-7.

- Levinsohn J, Petrin A. Estimating production functions using inputs to control for unobservables. Rev Econ Stud. 2003;70(2):317-41.

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref