Research Article - Journal of Finance and Marketing (2018) Volume 2, Issue 4

Evaluation of financial soundness of selected commercial banks in Nigeria: An application of Bankometer S-score model.

Onyema JI, Okey N, Precious O*, Amadi SNRivers State University, Port Harcourt, Nigeria

- Corresponding Author:

- Precious Onyinye

Rivers State University, Port Harcourt

Nigeria

Tel: +2348065265363

E-mail: preciousmodel1971@yahoo.com

Accepted date: November 20, 2018

Citation: Onyema JI, Okey N, Precious O, et al. Evaluation of financial soundness of selected commercial banks in Nigeria: An application of Bankometer S-score model. J Fin Mark. 2018;2(4):22-24.

DOI: 10.35841/finance-marketing.2.4.22-25

Visit for more related articles at Journal of Finance and MarketingAbstract

This study examines the financial soundness of ten commercial banks in Nigeria. Rather than using other models like CAMELS framework or CLSA-Stress test, a new effective model for measuring soundness of banks has been used in this study named “Bankometer S-score model”. Using this model, soundness of selected banks has been measured for a period of fifteen years (2000-2015). The Bankometer S-score model revealed that 2 banks; Bank G and D are at the top of the list having scores greater than 70 (126 and 113 respectively) indicating that the two banks are sound (S>70) and are in very healthy states whereas eight of the banks; Banks A, B, C, E, F, H, I and J have their scores below fifty (S<50) indicating that they are experiencing financial difficulties and high risk according to the Bankometer model. The study went further to test the significant difference of the variables in the Bankometer model using the Friedman rank test, the result showed that there is a significant difference in the banks studied using the Bankometer S-score model. Finally, this study concludes that Bankometer S-score model will definitely help the internal management of any bank in determining insolvency issues and removing the shortcoming generated from inefficiency in banking operations.

Keywords

Financial soundness, Commercial banks, Bankometer S-score model.

Introduction

Financial soundness evaluation is essential for the smooth operations of the banking sector, this is done to detect and remove potential vulnerabilities. The banking system provides a framework for economic transactions, any disruption in its activities affects both the depositors and creditors and also the overall economy making it mandatory for the efficient valuation of the soundness of the banks to ensure that corrective measures are timely to guard against its exposure to fragility. Therefore, it is not surprising that the banking sector is one of the most regulated in any economy.

Banks are important component of the financial sector of any economy because of their role as financial intermediaries that helps facilitate capital to promote productivity thereby enhancing growth and development in the economy, but this role can only be played effectively when the banks are health, sound and stable [1].

In response to the increased instability in the financial sector in many countries in the 1990’s, policy makers became interested in understanding the vulnerabilities in the financial systems and the development of measures that could help avert crises. Stress testing was identified as one of the principal techniques for quantifying financial sector vulnerability. “Stress testing” is a generic term describing various techniques used by financial institutions to measure their possible vulnerability to events that are exceptional but plausible [2]. Micro prudential analysis has been adopted as the assessment and monitoring of the strengths and vulnerabilities of a financial system.

The Bankometer model was developed by Shar, Shah & Jamali [3], following recommendations from the International Monetary Fund (IMF) on ‘Macro-prudential indicators of financial system soundness’. The methods are similar to the discriminate analysis in Altman’s [4-8] well known z-score for assessing the default probability of manufacturing companies. The model uses six bank-specific variables with various weights attached to each of them. They derived the weights using the CAMEL framework and parameters used in the Credit Leona’s Securities Asia (CLSA) stress test. This model has gained much attention in Asia, but it is still new to Nigerian banks. So far, Bankometer has been applied to Bangladesh, Indonesia and Pakistan [3-5].

A lot of theoretical and empirical studies have been conducted on banking sector soundness following the recent global financial crisis, such studies have shown that regulating and supervising the activities of the banking sector can go a long way in minimizing bank failure and stabilizing the financial system of any economy.

Ashraf & Tariq [3] evaluated the financial soundness of listed Pakistani banks in light of Bankometer and Z-score model for the period 2006-2014. Their result showed that both models reported almost same results classifying Bank of Punjab into grey zone. The study suggested that Bank of Punjab’s financial soundness is not that much satisfactory and more improvement is required to secure super sound bank status.

Uddin, Masud, & Kaium [6] researched on the financial soundness of selected private commercial banks of Bangladesh covering the period of 2006-2010. In this research different statistical tools and financial indicators were used to analyze the financial soundness of selected banks. It was found from the research that a bank with investments, higher deposits, branches, loans and employees does not always reflect better profitability. The research also recommended measures that could be implemented to ensure soundness in bank operations.

Kattel [7] examined the financial solvency of Selected Commercial Banks of Nepal using application of Bankometer covering the period 2007- 2012. The study established that all the private and joint venture banks are in sound financial position and private sector banks are financially sounder in comparison to joint venture banks. The study also concludes that this recent model for financial soundness measurement will help the bank's internal management in mitigating the insolvency issues by proper control and supervision system at the operational level.

Qamruzzaman [4] made an attempt to predict bankruptcy of selected private commercial Banks in Bangladesh using “Bankometer’s S-score and Altman “Z-score” model [8]. For this analyses, the researcher selected 20 banks from a pool made of 30 publicly listed commercial banks in Dhaka Stock exchange. He found that both Altman Z-score [8] and Bankometer’s S-score showed similar results about financial position of the selected banks in 2008, 2009 and 2010 but there were exceptions 2011 and 2012. Altman Z-score model [8] shows a little bankruptcy status while S-score model shows the health status of the whole banking industry.

Erari, Salim, SyafieIdrus & Djumahir [5], applied three different models such as; CAMEL, Z-score and Bankometer in assessing financial performance of P.T Bank Papua covering the period 2003-2011. Their study revealed that both CAMEL and Bankometer have showed same assessment in determining financial position but Altman’s Z-score model [8] has reversely put Papua banking industry in to gray zone. This study also implied that Z-score model is not suitable for evaluation of banking industry having some limitations. However, the study concluded that Z-score model provides early indication about bankruptcy in assessing financial performance and based on the results of above mentioned three models; Bank Papua’s profitability is good.

Makkar & Singh [9] examined the solvency of 37 Indian commercial banks covering the period of 2006-07 and 2010- 11 using the Bankometer model. They checked whether analyzing the vulnerability of financial distress on the banks is better than the conventional methods like CAMELS and CLSA Stress test. The study found that all the Indian banks are financially solvent and also showed that private sector banks are financially more sound than public sector banks. This study also revealed some unperformed banks and concluded that Bankometer model will assist internal management in avoiding insolvency issues.

Arulvel and Balaputhiran [10] conducted a study of financial performance analysis of private and state owned banks of Sri Lanka using statistical tools like Data Environmental Analysis, CAMELS and Bankometer model. The study covered the period 2006-2010 and assessed financial performance by applying different, they reported that state owned financial institutions performed better than the commercial counterparts.

Shar, Shah & Jamali [3] examined the performance of banking sector in Pakistan using the Bankometer model by applying it to test the solvency of each bank covering the period 1999- 2002 for evaluation in Pakistan. The results were compared with CAMEL and CLSA-stress test for conducting better comparison. The study concluded that Bankometer S-score scale can be applied at global level to predict the vulnerability of an individual bank.

Ivica, Maja & Bruno [11] carried out a study to assess companies’ bankruptcy using statistical tools from Croatia’s commercial banks. Exactly 78 Bankrupt Companies and 78 healthy companies were sampled and statistical model of DA and LR were used. DA model has 79% accuracy in bankruptcy predication while LR model is more robust.

Rahman [12] examined the soundness of twenty- four selected private banks in Bangladesh using the Bankometer model to measure the health status of selected banks from 2010 to 2015. The study revealed that all selected banks were sound individually and the financial system was in a favorable position during period under review.

This study aims at analyzing the financial soundness of the commercial banks that operate in Nigeria using the Bankometer S-score model.

Methodology

This study followed the quasi experimental research design to investigate and analyze the relationship among selected bank’s performances using the Bankometer S-score model. The data for this study is from 10 selected banks in Nigeria and the scope of the study is from 2000 to 2015 [13,14].

Bankometer S-score model

Bankometer ratios are derived from both the CAMELS and CLSA stress test parameters with some modifications. The changes in the selected ratios are made only to synthesize the measurement of banks soundness. Following IMF (2000) recommendations, the procedure of Bankometer is used to measure commercial banks in Nigeria. This procedure has the quality of minimum number of parameters with maximum accurate results. The parameters include:

1. Capital Adequacy Ratio (CA between 8% to 40%)

2. Capital to Assets Ratio (CAR higher than 4%)

3. Equity to total Assets (EAR greater than 2%)

4. NPLs to Loans (below 15%)

5. Cost to Income ratio (less than 40%)

6. Loan to Asset Ratio (below 65%)

The deterministic model for ascertaining financial soundness that was adopted here is Bankometer S-score is given by:

S = 1.5X1 + 1.2X2 + 3.5X3 + 0.6X4+ 0.3X5 + 0.4X6

Where,

S = Solvency

X1 = Capital to assets ratio (CA) ≥ 04%

X2 = Equity to assets ratio (EAR) ≥ 02%

X3 = Capital adequacy ratio (CAR): 40 % ≤ CAR ≥ 08%

X4 = Non-performing loans to loans ratio (NPL): ≤ 15%

X5 = Cost to income ratio (CI): ≤ 40%

X6 = Loans to assets ratio (LA): ≤ 65%

With the criteria that:

• When the value of S < 50, this means that the company is experiencing financial difficulties and high risk.

• When the value of 50 < S < 70 then the company is considered to be in the gray area.

• when S > 70, this shows that the company is in a very healthy state.

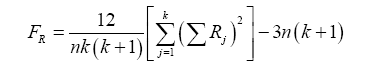

Friedman rank test

The Friedman Rank test is the non-parametric version of analysis of variance. it was adopted because of the ranking that was used in the Bankometer S-score models parameters and also because of the time series aspect of the data. The Friedman Rank Test is given by:

Where,

Rj - Rank for the jth subject

n - Number of observations

k - Number of subjects for comparison

The decision rule is to reject the null hypothesis if the calculated FR is greater that the tabulated FR at α level of significance or if the p-value is greater than the α level of significance.

Data Presentations and Discussion

Findings from the bankometer S-score

Table 1 is the result of analysis using solvency or Bankometer model. The result measured the Bank soundness using Bankometer S-score which assigned different weight to the variables of the model as shown in the equation above.

| NAME OF BANKS | CA | EAR | CAR | NPL | CI | LA | S-score | Rank |

|---|---|---|---|---|---|---|---|---|

| Bank A | 0.2713 ± 0.030 | 0.1713 ± 0.065 | 10.8475 ± 4.52 | 0.4925 ± 0.262 | 0.2788 ± 0.080 | 0.1106 ± 0.096 | 39 | 4 |

| Bank B | 0.2863 ± 0.016 | 0.2856 ± 0.257 | 9.2600 ± 3.74 | 0.0738 ± 0.106 | 0.1869 ± 0.049 | 0.0769 ± 0.090 | 33 | 8 |

| Bank C | 0.2644 ± 0.015 | 0.1644 ± 0.078 | 13.4431 ± 8.56 | 0.3600 ± 0.276 | 0.2375 ± 0.023 | 0.4425 ± 0.161 | 48 | 3 |

| Bank D | 0.2738 ± 0.014 | 0.1081 ± 0.046 | 32.0788 ± 38.3 | 0.3150 ± 0.249 | 0.1975 ± 0.051 | 0.4063 ± 0.242 | 113 | 2 |

| Bank E | 0.2081 ± 0.014 | 0.1519 ± 0.034 | 10.4431 ± 3.28 | 1.1088 ± 2.543 | 2.0356 ± 7.191 | 1.7469 ± 5.934 | 39 | 4 |

| Bank F | 0.2338 ± 0.016 | 0.4806 ± 0.293 | 9.2306 ± 2.86 | 0.1750 ± 0.209 | 0.2494 ± 0.044 | 0.2563 ± 0.148 | 34 | 7 |

| Bank G | 0.2338 ± 0.012 | 0.3288 ± 0.284 | 35.6556 ± 36.5 | 0.2688 ± 0.261 | 0.2506 ± 0.039 | 0.4081 ± 0.145 | 126 | 1 |

| Bank H | 0.2281 ± 0.014 | 0.0956 ± 0.038 | 9.8231 ± 4.51 | 0.1775 ± 0.134 | 0.2275 ± 0.058 | 0.2819 ± 0.092 | 35 | 6 |

| Bank I | 0.2469 ± 0.024 | 0.2831 ± 0.196 | 10.6550 ± 3.93 | 0.1681 ± 0.160 | 0.2231 ± 0.067 | 0.3206 ± 0.178 | 38 | 5 |

| Bank J | 0.2394 ± 0.021 | 0.1606 ± 0.070 | 8.7794 ± 3.31 | 0.2419 ± 0.173 | 0.3044 ± 0.061 | 0.4738 ± 0.217 | 32 | 9 |

| Source: SPSS Version 20 (Authors' own estimation) | ||||||||

Table 1: Mean value of Bankometer variables and S-score.

The result also shows the descriptive statistics (mean and standard deviation) of the variables for the models. Among which are capital to assets ratio (CA), equity to assets ratio (EAR), capital adequacy ratio (CAR), non-performing loans to loans ratio (NPL), cost to income ratio (CI), and loans to assets ratio (LA). Based on the scaling of these variables, all the banks are sound except in non-performing loans to loans ratio (NPL) where only Bank B has its value less than 15% which is the standard. Also it was discovered that the loans to assets ratio (LA) for Bank E was out of range from the standard. Based on the overall ranking, Bank G was leading followed by Bank D while Bank J is the least in the rank.

Findings from the friedman rank test

Table 2 shows the result of analysis of solvency (Bankometer S-score) of the bank on average as well as that of the years for all the banks under review. A significant (p<0.05) difference in solvency was found among the 10 banks and between the years of study for the entire banks. The Friedman Statistic was 35.48 and 113.51 for the banks and years analysis respectively. Bank G ranked the highest in solvency while Bank J ranked the lowest. On the time related analysis, the solvency was highest in 2015 and lowest in 2002.

| Bank | Median | Sum of Rank | Year | Median | Sum of Rank |

|---|---|---|---|---|---|

| Bank A | 33.42 | 85 | 2000 | 22.34 | 34 |

| Bank B | 29.61 | 57 | 2001 | 21.83 | 31 |

| Bank c | 36.73 | 108 | 2002 | 21.05 | 21 |

| Bank D | 33.91 | 85 | 2003 | 23.48 | 41 |

| Bank E | 35.07 | 102 | 2004 | 25.60 | 48 |

| Bank F | 33.59 | 88 | 2005 | 27.93 | 63 |

| Bank G | 53.16 | 128 | 2006 | 30.55 | 75 |

| Bank H | 32.96 | 82 | 2007 | 33.34 | 87 |

| Bank I | 34.79 | 100 | 2008 | 34.73 | 94 |

| Bank J | 29.07 | 45 | 2009 | 39.00 | 104 |

| Freidman Statistic =35.48 p-value = 0.000 |

2010 | 47.77 | 106 | ||

| 2011 | 50.73 | 109 | |||

| 2012 | 55.09 | 135 | |||

| 2013 | 55.37 | 134 | |||

| 2014 | 55.64 | 135 | |||

| 2015 | 56.93 | 143 | |||

| Freidman Statistic=113.51 p-value = 0.000 |

|||||

| Source: Mini tab Version 15 | |||||

Table 2: Analysis of Solvency (S-score) using Friedman Rank Test.

Conclusion

Although, this model is not widely familiar and is yet to be recognized as a valid analysis for financial soundness of banks, this model has been tested by many researchers around the world for predicting the financial soundness of banks and comparing the results between insolvent and bankrupt banks because of its simplicity. The study concludes that this newly established Bankometer model will definitely help the bank’s internal management to avoid insolvency issues by controlling their operations properly and remove the shortcoming generated from inefficiency in dealing with banking activities. This study also suggests that banks maintain consistent solvency to ensure sound financial system which is the pre-requisite for the economic growth of the country.

Recommendation

Based on the findings of the study, bank managers should focus on ensuring that their banks are well capitalized, minimize levels of non-performing loans, maintain sound management and ensure adequate liquidity so as to sustain banks’ financial soundness and mitigate against vulnerability. Faced with trend of unsound banks, the regulator should consider adopting Bankometer S-score models for commercial bank soundness assessment in addition to other models since this model can specifically state the banks that are unsound.

References

- Okey-Nwala PO. Financial soundness of deposit money banks in Nigeria. An application of camels and bankometer models. (unpublished doctoral thesis). Rivers state university, Port Harcourt 2018.

- BIS: Interbank Market during a crisis 2001.

- Shar AH, Shah MA, Jamali H, et al. Performance evaluation of pre-and post-nationalization of the banking sector in Pakistan: An application of camel model. Afr J Bus Manag. 2010;5(3):747.

- Qamruzzaman. Predicting bankruptcy: Evidence from private commercial banks in Bangadesh. Int J Fin Eco. 2014;2(3):114-21.

- Erari A, Salim U, Irdus MS, et al. Financial performance analysis of PT. Bank Papua: Application of camel, Z-Score and bankometer. J Bus Manag. 2013;08-16.

- Uddin MM, Masud M, Kaium A, et al. Financial health soundness measurement of private commercial banks in Bangladesh: An observation of selected banks. J Nep Bus Stud. 2015;9(1).

- Kattel IK. Evaluating the financial solvency of selected commercial banks of Nepal: An application of bankometer. J Adv Aca Res. 2015;1(1):88-95.

- Altman EI. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Fin. 1968;23(4):589-609.

- Makkar A, Singh S. Analysis of the financial performance of Indian commercial banks: A comparative study. Ind J Fin. 2012;7(5):41-9.

- Arulvel KK, Balaputhiran S. Financial position of banking sector: A comparative study between state and private sector banks in Sri Lanka. Int Multidis Res J. 2013;3(2):212-21.

- Ivica P, Maja P, Bruno V, et al. Prediction of company bankruptcy using statistical techniques- Case of Croatia. Croatian Operational Research. 2011;2:1.

- Rahman Z. Financial soundness evaluation of selected commercial banks in Bangladesh: An application of bankometer model. Res J Fin Acc. 2017;8(2):2222-847.

- Kenn-Ndubuisi J, Akani HW. Effects of recapitalization on commercial banks survival in Nigeria: Pre and Post camel analysis. Eur J Acc. 2015;3(9):12-30.

- Ashraf A, Tariq YB. Evaluating the financial soundness of banks: An application of bankometer on Pakistani listed banks. J Fin Risk Manag. 2016;13(3):47.