Research Article - Journal of Finance and Marketing (2019) Volume 3, Issue 1

Does it influence? Macro variables on stock returns.

Jamal S*, Mujtaba MManagement Sciences at Shaheed Zulfikar Ali Bhutto Institute of Science and Technology, Karachi, Pakistan

- *Corresponding Author:

- Jamal S

Management Sciences at Shaheed Zulfikar Ali Bhutto

Institute of Science and Technology

Karachi,Pakistan

Tel: +03330350019

E-mail: Imran_Js@Yahoo.com

Accepted date: December 24, 2018

Abstract

Purpose: This study comprise purpose to investigate relationship between stock returns & macroeconomic indicators of Pakistan. In this research consider macroeconomic variables i.e. Gross Domestic Production (GDP), Foreign Direct Investment (FDI) has been studied with relation to stock returns having influential factor political regime of the country during the period research has been carried out. It has been observed significant impact on stock with variations in macroeconomic variables with the passage of time and also observed how significantly impact of changes in political regime on stock returns.

Methodology/sample: Research would be explanatory in nature. Based on secondary time series data of stock 100 index and selected macro-economic variables yearly data from 2003 to 2017 and political regime as controlling variable has been observed during the period research has conducted. For research data analysis regression equation has developed and test run on Eviews 8.0 simple regression to check overall fitness of model, individual significance of each variable, and auto correlation between predictor variables. As well as satisfying time series data requirement Heteroskedasticity Test: Breusch-Pagan-Godfrey to check variance in each data series, Breusch-Godfrey Serial Correlation LM Test to test serial correlation between variables, unit root test -Augmented Dickey Fuller has been used to check stationary of data.

Findings: Results shows value of R2 is 91% shows goodness of fitness of the model. F-test 39.67% shows overall model is significant. As far as concerned individuality significance GDP & political stability significance but FDI value not showing significance itself. Durbin-Watson value 2.309941 shows auto correlation between GDP & FDI. In Breusch-Godfrey Serial Correlation LM Test: value of P-value chi-square 0.2087, 20.87% which is greater 10% shows auto correlation exists in model. In Heteroskedasticity Test: Breusch-Pagan-Godfrey P-value chi-squares greater than 0.05 its means variance & un equality in data exist. In Unit root test P value of FDI & Political regime is less than 0.05 shows stationary in data series, while GDP is not showing stationary in data series.

Practical Implications: This study endorsed the Arbitrage Pricing Theory (ATP) developed by Ross (1976) is way of linking macroeconomic variables to stock market return, shows how macro variables having impact on stock returns with influence of political regime in a country with every successive time period operating as controlling element in the country having significant impact on economy of the state. This study has empirical evidences carried on other macro variables. For future this study would help to analyze how defined variables impact on stock returns and how much political regime having significant impact on economy would take extension in the theory. Stock returns boost or decline as per political stability of the country which have parallel variant economic indicators.

Keywords

GDP, FDI, Political stability, Stock returns, Variance, Heteroskedasticity

Introduction

In every state stock exchange market is always remain the hub of business transactions where buyers and sellers can take place transactions of numerous kind of securities at an offer price. As far as concern to stock market plays a crucial role in the mobilization of capital in emerging markets of developed and under developed countries, leading towards the growth of industrial sector and overall economy of the country, many growth-oriented countries may oblige global polies of trade and commerce. Macroeconomic indicators/ variables are performed as signal for stock market investors to predict future stock price weather higher or lower return while investing in stocks.

This research has been carried to extensively go through past researches literature. Economic variables have greater influence on stock prices [1]. Some of the core variables identify by the investors influence on stock market that they do focus on such certain variables while investing in stock market and will have an advantage to make their own decisions.pf investment. Investment in stock market is risky with respect to volatility in economic variables result may in reward or loss. Many economics theories endorsed macro variables effect returns on investment: the foreign direct investment (FDI), oil prices, GDP, trade openness, government bonds, unemployment, currency depreciation, currency exchange rate, Per capita consumer expenditure and many more other economic variables.

They have significant risk on stock returns. This empirical research would help the future researchers to understand the rarely noticed variables have their significant effect on stock returns. It is very common perception that stock react sensitively to economic news. It is experience on day to day life that any event occurs in country some have temporal basis effect while others have more drastically effect on stock returns in particular time period. Investor ability depend to what extent they have in-depth knowledge of company profile, economic & political condition of the state, how perfectly predict economic variables volatility as, modern financial theory has focused on pervasive, or systematic, influences to minimize investment risk.

This study aims to define stock returns having influence by one of the core reasons is economic indicators fluctuation and these based on political stability or situation occur in the country in prescribed time period. This research carried out on data of PSX 100 index from 2003 to 2017 and designated macro variables, also acknowledgement of past researchers. This research would help investors and futures researchers to find empirical evidences for further study other macro variables in available political scenario of future impact on stock returns.

Literature Review

Initially, economist Keynes identify stock prices fluctuations in (1936) numerous studies has been carried on relationship between macroeconomic variables and stock market performance in emerging markets of the state. In (2013) Naik [2] who had studies and investigated the relationships between the stock market index, industrial production index, wholesale price index, money supply, treasury bills rates and exchange rates. Among all these studies that have been carried out for presented a relationship between macroeconomic variables and stock market in the different countries include (“Abraham, 2010”; “Olweny and Omondi, 2011”; “Adarmola, 2012” and “Naik, 2013”) [2-6]. Many economic variables having significant effect on stock market returns these variables include Money supply, Exchange rates, Inflation, Interest rates and T- bill rates (Ouma; Dr. Muriu, 2014) [7,8]. It is commonly known by every investor in the market that stock returns react sensitively on economic news. State own unanticipated event also influenced on stock returns. A gap exists between the theoretically evidences of importance of systematic "state variables" and neglect the empirical evidences. There are some external effects that result in volatility of economic variables. But, generally it is unable to determine that which economic state variables will highly influence stock market. Any systematic variables that affect the economies with respect to stock market growth. The following economic variables have systematically effect on stock market returns: the spread between long and short interest rates, expected and unexpected inflation, industrial production, and the spread between high- and low grade bonds. It can say that at the same level all economic variables are endogenous and exogenous in some ultimate sense (Chen; Roll; Ross, 1986) [9-11]. It is commonly knowing the importance of macroeconomic variables changes in stock prices: Industrial Production, Foreign Exchange Reserves and Oil Prices variables [1]. Stock returns are commonly believed to react sensitively on macroeconomic variables it is implicit effect in capital market theory, some selective economic state variables having influence on the rate of return of large stockmarket aggregates.

A systematic review shows that economic indicators, stock dividend, would also influence stock-market returns Chen et al. [9]. Many past empirical studies have confirmed the long-run and positive relationship between stock return and economic variable, carry simple argument that set of state variables having significant impact in explaining expected return and also influenced by economic and political news occur in the state. (Schwert, 1990; Roll, 1992) [10,12].

In order to make smart and effective investment decision an accurate estimation of future changes in economic variables and stock market behavior enables investors to invest in local and foreign market. For the policy makers, highly probable prediction of the economic variable may help in designing policies to encourage more capital inject in economy of the countries capital markets. Many empirical research has shown results for macro-economic factors and their impact on stock-market returns results randomly generated series of numbers in return co-variation with on another Chan et al. [9]. It is highly important to know for academic researcher and investment practitioner which factors best capture the systematic components of stock return variation (Mishra; Singh, 2010). The process of the capital control having empirical evidences with respect to financial globalization. Development of the stock market has been the growing participation of institutional investors, both foreign investors (FIIs) and local investors [8].

Inflation is one of the core factor that discourage the corporate sector investors in production process. This uncertain change in inflation rate implies on decline of stock market which back by low GDP of the state and lower the return of investors (Schwert, 1981).

The higher the level of stock market volatility apparently decline in financial stability of the company concentrated mind by the investors of the market and policy makers. (Borio; Kennedy; and Prowse, 1994). Researchers have centered their empirical studies on this relationship between stock market return dependent on macroeconomic variables and this has been intensively examined in both emerging and developed capital markets [13,14].

It has examined that gold prices, oil prices and stock prices exist no long term relationship Irshad et al. Dynamic relationship between key macroeconomic indicators of Pakistan including stock market, gold prices, exchange rate and oil prices, significant variations has been observed over to time in stock market [6].

In order to gauge the relationship between stock returns and macro variables volatility with control political situation in different perspectives. First, was to find out the impact of style of government on stock market returns. Second, to identify the type of impact in both form of government by comparing economic progress weather democratic and dictatorship government. Third objective was to compare the stock market fluctuations and performance in both forms of government (Conference source; 2017) [15].

Methodology

The philosophical concept of research is epistemology, philosophical paradigm is post-positivism, research approaches is quantitative in nature research design having deductive approach and research method survey based data from 2003 to 2017.

Data has collected from secondary source data available on websites: State bank of Pakistan, Pakistan statistical bureau and Pakistan stock exchange 100 index data. Data has collected on annual basis. In order to get desire results the entire data has compiled in desire format as required by this research area. For diagnose data test statistical software Eviews 8.0 has been used.

Research questions

• What is the relationship between stock returns and GDP?

• What relation exists between stock returns and FDI?

• Does any impact on stock return of political regime of the country?

Research objectives

• To determine relationship between stock returns and GDP.

• To identify relationship exists between stock returns and FDI.

• To know how stock return influence because of political regime of the country.

Conceptual frame work

SR = α + β1 (GDP) + β2 (FDI) + β3 (PR) + €i

As per conceptual framework, the linear equation drives as:

• SR = Stock Returns

• GDP = Gross Domestic Production

• FDI = Foreign Direct Investment

• PR = Political Regime

As:

HO = β1 = β2= β3 = 0

HA = β1 = β2= β3 ≠ 0

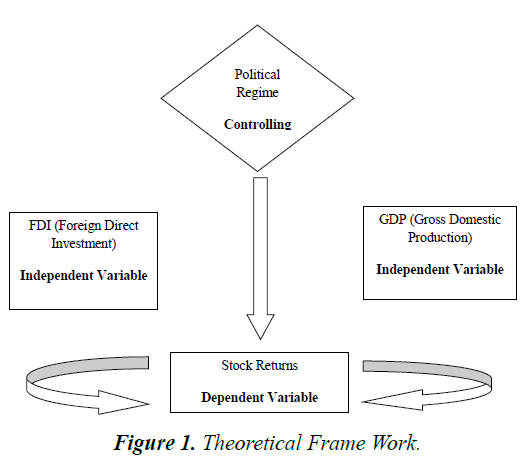

Theoretical frame work

The theoretical frame work is explained with the help of a chart describe below Figure 1.

Analytical technique

Analytical technique that on the basis of compiled data and run on statistical software Eviews 8.0 version. For data interpretation regression equation has developed and test simple regression to check overall fitness of model, individual significance of each variables and auto correlation between predictor variables. As well as satisfying time series data requirement Heteroskedasticity Test: Breusch-Pagan- Godfrey to check variance in each data series, Breusch- Godfrey Serial Correlation LM Test to test serial correlation between variables, unit root test -Augmented Dickey Fuller has been used to check stationary of data.

Result

Analysis of regression

In order to find out the value of one dependent variable and by the help of other independent variable and for overall model significance regression analysis can be used.

In the above Table 1 shows R-squared =0.915411, when multiplied by 100 it indicates 91.54% goodness of the fitness of model. ANOVA shows overall model significance. In above table shows value of “F” is 39.67 when value of variable “F” is significant and will be greater than 3.75 i.e. F >3.75 that the model is acceptable and variations occurred not by chance, where as if table shows insignificance value of variable “F” will be less than 3.75 i.e. F< 3.75 that the model will not be acceptable and the variation shown therein will be just by chance. Durbin-Watson value 2.309941 shows auto correlation between predictor variables GDP, FDI & Political Stability. As far as concerned to individual significance t-statistics shows FDI t-value -0.9739 which is not ≥ 2 and P-value 0.35 which is not ≤ 0.05 its mean Ho is fails to reject and H1 is rejected, GDP t-value 8.7319 which is ≥ 2 and P-value 0.00 which is ≤ 0.05 its mean Ho is rejected and H1 is accepted Political regime t-value 2.9481 which is ≥ 2 and P-value 0.01 which is ≤ 0.05 its mean Ho is rejected and H1 is accepted.

| Dependent Variable: STOCK_VALUE | ||||

|---|---|---|---|---|

| Method: Least Squares | ||||

| Date: 12/7/17 Time: 10:57 | ||||

| Sample: 115 | ||||

| Included observations: 15 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -81295.68 | 12307.42 | -6.60542 | 0 |

| FDI | -0.816022 | 0.837806 | -0.973999 | 0.351 |

| GDP | 0.011023 | 0.001262 | 8.731954 | 0 |

| POLITICAL REGIME | 11851.68 | 4020.013 | 2.94817 | 0.0133 |

| R-squared | 0.915411 | Mean dependent var | 18844.23 | |

| Adjusted R-squared | 0.892341 | S.D. dependent var | 13641.07 | |

| S.E. of regression | 4475.835 | Akaike info criterion | 19.87395 | |

| Sum squared resid | 2.20E+08 | Schwarz criterion | 20.06277 | |

| Log likelihood | -145.0546 | Hannan-Quinn criter. | 19.87194 | |

| F-statistic | 39.67998 | Durbin-Watson stat | 2.309941 | |

| Prob (F-statistic) | 0.000003 | |||

Table 1: Regression Analysis.

Heteroskedasticity analysis

Heteroskedasticity Test: Breusch-Pagan-Godfrey is used to check variance in each data series.

In the above Heteroskedasticity Test: Breusch-Pagan-Godfrey table F-static is < 3.75, observed R-square 3.05% only and P-value chi-squares greater than 0.05 its means variance & un equality in all data series exist. Overall variance shows in the time series data of each of the variable (Table 2).

| F-statistic | 0.936452 | Prob. F (3,11) | 0.4558 | |

| Obs*R-squared | 3.05158 | Prob. Chi-Square (3) | 0.3837 | |

| Scaled explained SS | 1.63166 | Prob. Chi-Square (3) | 0.6522 | |

| Test Equation: | ||||

| Dependent Variable: RESID^2 | ||||

| Method: Least Squares | ||||

| Date: 12/7/17 Time: 11:03 | ||||

| Sample: 115 | ||||

| Included observations: 15 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -55180739 | 59370059 | -0.929437 | 0.3726 |

| FDI | -1367.304 | 4041.511 | -0.338315 | 0.7415 |

| GDP | 7.982399 | 6.089534 | 1.310839 | 0.2166 |

| POLITICAL REGIME | 7731528 | 19392236 | 0.398692 | 0.6978 |

| R-squared | 0.203439 | Mean dependent var | 14690938 | |

| Adjusted R-squared | -0.013805 | S.D. dependent var | 21443576 | |

| S.E. of regression | 21591087 | Akaike info criterion | 36.83664 | |

| Sum squared resid | 5.13E+15 | Schwarz criterion | 37.02545 | |

| Log likelihood | -272.2748 | Hannan-Quinn criter. | 36.83463 | |

| F-statistic | 0.936452 | Durbin-Watson stat | 2.57506 | |

| Prob(F-statistic) | 0.45584 | |||

Table 2: Heteroskedasticity Test: Breusch-Pagan-Godfrey.

Breusch-godfrey serial correlation LM test analysis

In Breusch-Godfrey Serial Correlation LM Test shows serial correlation exist in the model between dependent & independent variable.

In the above Table 3 shows Breusch-Godfrey Serial Correlation LM Test value of P-value chi-square 0.2087, 20.87 % which is greater 10 % shows auto correlation exists in model. Having correlation exist between dependent & independent variables.

| F-statistic | 1.177735 | Prob. F (1,10) | 0.3033 | |

| Obs*R-squared | 1.580465 | Prob. Chi-Square (1) | 0.2087 | |

| Test Equation: | ||||

| Dependent Variable: RESID | ||||

| Method: Least Squares | ||||

| Date: 12/7/17 Time: 11:10 | ||||

| Sample: 115 | ||||

| Included observations: 15 | ||||

| Presample missing value lagged residuals set to zero. | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -5047.249 | 13065 | -0.386318 | 0.7074 |

| FDI | -0.335956 | 0.8869 | -0.378799 | 0.7128 |

| GDP | 0.000636 | 0.001383 | 0.459997 | 0.6554 |

| POLITICAL REGIME | 1539.493 | 4232.719 | 0.363713 | 0.7236 |

| RESID (-1) | -0.397987 | 0.366729 | -1.085235 | 0.3033 |

| R-squared | 0.105364 | Mean dependent var | -6.97E-12 | |

| Adjusted R-squared | -0.25249 | S.D. dependent var | 3967.404 | |

| S.E. of regression | 4440.108 | Akaike info criterion | 19.89595 | |

| Sum squared resid | 1.97E+08 | Schwarz criterion | 20.13196 | |

| Log likelihood | -144.2196 | Hannan-Quinn criter. | 19.89343 | |

| F-statistic | 0.294434 | Durbin-Watson stat | 1.916516 | |

| Prob (F-statistic) | 0.875023 | |||

Table 3. Breusch-Godfrey Serial Correlation LM Test Analysis.

Unit root test analysis

In the above unit root test of each of the variable shows stationary in data series at level P value of Augmented Dickey-Fuller Test of FDI is 0.0507 this shows series is stationary and null hypothesis rejected and alternative accepted, P value of Augmented Dickey-Fuller Test of Political Regime is 0.0218 this shows series is stationary and null hypothesis rejected and alternative accepted, P value of Augmented Dickey-Fuller Test of GDP is 0.4228 this shows series is not stationary and null hypothesis fails to reject and alternative is accepted (Table 4).

| Null Hypothesis: FDI has a unit root | ||||

|---|---|---|---|---|

| Exogenous: Constant | ||||

| Lag Length: 1 (Automatic - based on SIC, maxlag=3) | ||||

| Augmented Dickey-Fuller test statistic | t-Statistic | Prob.* | ||

| -3.111423 | 0.0507 | |||

| Test critical values: | 1% level | -4.05791 | ||

| 5% level | -3.11991 | |||

| 10% level | -2.701103 | |||

| *MacKinnon (1996) one-sided p-values. | ||||

| Warning: Probabilities and critical values calculated for 20 observations and may not be accurate for a sample size of 13 | ||||

| Augmented Dickey-Fuller Test Equation | ||||

| Dependent Variable: D(FDI) | ||||

| Method: Least Squares | ||||

| Date: 12/07/17 Time: 19:42 | ||||

| Sample (adjusted): 315 | ||||

| Included observations: 13 after adjustments | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| FDI(-1) | -0.568974 | 0.182866 | -3.111423 | 0.011 |

| D(FDI(-1)) | 0.552219 | 0.215854 | 2.558297 | 0.0285 |

| C | 1859.096 | 631.2611 | 2.945051 | 0.0147 |

| R-squared | 0.566747 | Mean dependent var | 117.4769 | |

| Adjusted R-squared | 0.480097 | S.D. dependent var | 1168.751 | |

| S.E. of regression | 842.72 | Akaike info criterion | 16.51032 | |

| Sum squared resid | 7101769 | Schwarz criterion | 16.64069 | |

| Log likelihood | -104.3171 | Hannan-Quinn criter | 16.48352 | |

| F-statistic | 6.540604 | Durbin-Watson stat | 2.521424 | |

| Prob (F-statistic) | 0.015265 | |||

| Null Hypothesis: D(GDP) has a unit root | ||||

| Exogenous: Constant | ||||

| Lag Length: 0 (Automatic - based on SIC, maxlag=3) | ||||

| Augmented Dickey-Fuller test statistic | t-Statistic | Prob.* | ||

| -1.668116 | 0.4229 | |||

| Test critical values: | 1% level | -4.05791 | ||

| 5% level | -3.11991 | |||

| 10% level | -2.701103 | |||

| *MacKinnon (1996) one-sided p-values. | ||||

| Warning: Probabilities and critical values calculated for 20 observations and may not be accurate for a sample size of 13 | ||||

| Augmented Dickey-Fuller Test Equation | ||||

| Dependent Variable: D(GDP,2) | ||||

| Method: Least Squares | ||||

| Date: 12/07/17 Time: 19:45 | ||||

| Sample (adjusted): 315 | ||||

| Included observations: 13 after adjustments | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| D(GDP(-1)) | -0.475323 | 0.284946 | -1.668116 | 0.1235 |

| C | 183176.6 | 110804.1 | 1.653157 | 0.1265 |

| R-squared | 0.201893 | Mean dependent var | 7723.923 | |

| Adjusted R-squared | 0.129338 | S.D. dependent var | 134673 | |

| S.E. of regression | 125662.4 | Akaike info criterion | 26.46122 | |

| Sum squared resid | 1.74E+11 | Schwarz criterion | 26.54814 | |

| Log likelihood | -169.998 | Hannan-Quinn criter | 26.44336 | |

| F-statistic | 2.782611 | Durbin-Watson stat | 1.81441 | |

| Prob(F-statistic) | 0.123477 | |||

| Null Hypothesis: D(POLITICAL REGIME) has a unit root | ||||

| Exogenous: Constant | ||||

| Lag Length: 0 (Automatic - based on SIC, maxlag=3) | ||||

| Augmented Dickey-Fuller test statistic | t-Statistic | Prob.* | ||

| -3.605551 | 0.0218 | |||

| Test critical values: | 1% level | -4.05791 | ||

| 5% level | -3.11991 | |||

| 10% level | -2.701103 | |||

| *MacKinnon (1996) one-sided p-values. | ||||

| Warning: Probabilities and critical values calculated for 20 observations and may not be accurate for a sample size of 13 | ||||

| Augmented Dickey-Fuller Test Equation | ||||

| Dependent Variable: D(POLITICALREGIME,2) | ||||

| Method: Least Squares | ||||

| Date: 12/07/17 Time: 19:46 | ||||

| Sample (adjusted): 315 | ||||

| Included observations: 13 after adjustments | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| D(POLITICAL REGIME(-1)) | -1.083333 | 0.300463 | -3.605551 | 0.0041 |

| C | 0.083333 | 0.083333 | 1 | 0.3388 |

| R-squared | 0.541667 | Mean dependent var | 0 | |

| Adjusted R-squared | 0.5 | S.D. dependent var | 0.408248 | |

| S.E. of regression | 0.288675 | Akaike info criterion | 0.493609 | |

| Sum squared resid | 0.916667 | Schwarz criterion | 0.580524 | |

| Log likelihood | -1.208456 | Hannan-Quinn criter. | 0.475744 | |

| F-statistic | 13 | Durbin-Watson stat | 2.015152 | |

| Prob(F-statistic) | 0.00413 | |||

Table 4: Unit Root Test Analysis.

Discussion

This research has fulfilled all its objectives to explain relationship between stock returns & macro variables taking political regime as control variable in the research frame work define in this research. As far as concerned, data based on PSX 100 index and other macro variables from 2003 to 2017. Analytical technique has been used in this research to test overall model significance, individual variable significance, auto correlation of predictor variables, stationary of time series data, results shows overall data is significant and each predictor variable best explained its presence in the model. Stock market is one of key resource of any economy of the state. Stock profitability effects by variation occur in macro-economic variables with the passage of time. This research would help the future researcher and investors to analyze macro factors while stock investment with taking in consideration current political active regime in the country.

Conclusion

This research has been carried out to explain dynamic relationship between stock returns & predictor variables i.e. FDI, GDP and one control variable that is political regime taking stock 100 index and other variables yearly time series data which were available by secondary sources from 2003 to 2017 of 15 years data during which political regime imposed in country and analyze stock return variations because of variations in macro-economic variables based on one of the factor of political stability in the country in desired time period. Data compiled and statistical tools have been used to interpretation data. Results shows overall model significant and significant figure shows goodness of the fitness of the model. Individual significance shows variable GDP and political regime whereas FDI not showing individual significance and overall Ho is rejected and H1 fails to reject. Research shows stock returns having impact of macroeconomic variables influenced by political situation of the state. As far as concerned to future researcher would help to find empirical study on this area and with the help of this study conduct research on the other macro variable and future data of stock index. While limitations of this study to get expert opinion about economic development in real time with respect to sock returns. Research based by Arbitrage Pricing Theory (ATP) is way of linking macroeconomic variables to stock market addition with this research in the concept based in this theory to study real time effect with present political government ruled in the country.

References

- Adnan H, Musleh-ud D, Ejaz G, et al. Monetary policy, informality and business cycle fluctuations in a developing economy vulnerable to external shocks. SBP Work Pap Ser No.65. 2013.

- Alok B. Firms’ fundamentals, macroeconomic variables and quarterly stock prices in the US. J Econom. 2014;183(2):241-50.

- Ben B, Mark G. Monetary policy and asset price volatility. NBER Work Pap Ser 7559. 2000.

- Christian G, Larry R, John R, et al. Long-term economic and market trends and their implications for asset/liability management of insurance companies. J Risk Fin. 2003;4(2):5-18.

- Doron A. Stock Return predictability and asset pricing models. The Robert H. Smith School of Business. 2000.

- Farhan, Kashif, Farjad, et al. Dynamic relationship between gold prices oil prices, exchange rate and stock returns: empirical evidences from Pakistan. 2017.

- Jay S, Mark IW. 2005, Macroeconomic variables and asset further results, bradley policy research center. Manag Eco Res Work Pap Ser. 2005.

- Mishra, Sagarika S, Harminder. Do macro-economic variables explain stock-market returns? Evidence using a semi-parametric approach. 2010.

- Nai-Fu C, Richard R, Stephen A, et al. Economic forces and the stock market. J Bus. 1986;59(3):383-403.

- Robert JB, José FU. Stock-market crashes and depressions. Harvard University. 2009.

- Sheilla N, Odhiambo NM. Economic growth and market-based financial systems: A review. Stud Eco Fin. 2015;32(2):235-55.

- Talla, Tagne, Joseph, et al. Impact of macroeconomic variables on the stock market prices of the Stockholm stock exchange (OMXS30). Master´s thesis within international financial analysis. 2013.

- Thorsten B, Ross L. Stock markets, banks, and growth: Panel evidence. J Bank Fin. 2002.

- Wycliffe NO, Peter M. The impact of macroeconomic variables on stock market returns in Kenya. Int J Bus Comm. 2014;3:11.

- Impact of style of government on Pakistan stock market volatility: Democracy vs. Dictatorship.